Lupus alpha CLO High Yield Invest CAV

Lupus alpha CLO High Quality Invest offers UCITS compliant access to a diversified portfolio of secured corporate loans based on collateralised loan obligations (CLOs). The fund enables investors to achieve attractive returns with low interest rate sensitivity.

A presentation is made after a term of 12 months. For further information, please contact us at +49 69 365058-7000 or service@lupusalpha.de.

Access to the European CLO market and thus a broadly diversified European corporate loan portfolio

- Transparency and liquidity of a UCITS IV-compliant mutual fund

Opportunity for high returns through investments in the high yield segment (tranches rated BB and B)

- High level of expertise from CLO portfolio management team

Lupus alpha CLO High Yield Invest is managed by a highly experienced team of CLO experts who have been working together successfully for more than a decade. The fund can also build on more than a decade of proven Fixed Income Credit expertise of Lupus alpha:

EXPERIENCED TEAM

... with an average of 20 years of management experience

EXPERIENCED RISK MANAGEMENT

... methodically reliable and with an excellent track record in terms of default risk

ACCESS TO PROPRIETARY DATABASES

... with comprehensive market data

TRADING PROCESSES

... which are under the full control of their own portfolio management

Lupus alpha CLO High Yield Invest offers investors access to a diversified portfolio of secured corporate loans based on collateralised loan obligations (CLOs). CLOs are securitised investments in corporate loans issued by a securitisation vehicle that are assembled by asset managers and divided into tranches according to the level of credit risk of the investments in question. Lupus alpha CLO High Yield Invest is focused on CLO tranches in the rating segment BB-B. In consequence, the mutual fund addresses investors with ambitious return objectives beyond the traditional corporate bond market and that are capable of withstanding price volatility and temporal losses.

Each individual CLO is managed by a CLO manager. Lupus alpha CLO High Yield Invest selects the best CLOs from those available on the market according to specific criteria (e. g. cash flow stability or historic default rates).

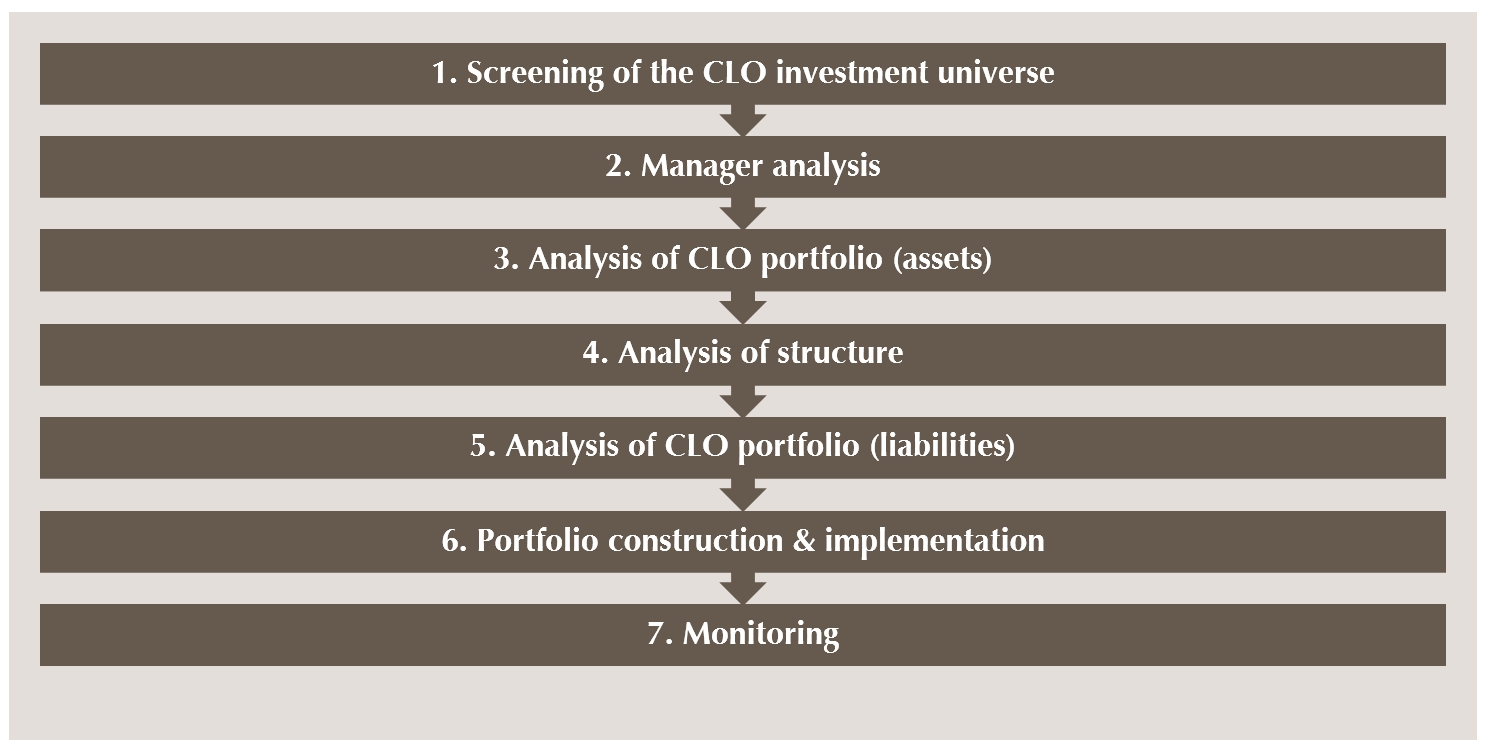

The selection process for individual CLOs is divided into a number of stages:

In the first stage, managers assess the relative attractiveness of the CLOs available on the market based on comprehensive market research. Managers then assess the capital structure of each individual CLO using risk and return criteria while taking existing investment guidelines into account.

Active management of the loan pool (by the CLO manager) as well as the active selection of CLO tranches by Lupus alpha allows for alpha potential on two tiers.

The fund pursues a return target of money market + 5% p. a., while exhibiting a moderate level of volatility. Interest income is distributed regularly, providing investors with remunerative cash flows.

Experienced fund managers

Lupus alpha’s Fixed Income Credit team managing the Lupus alpha CLO High Yield Invest is characterized by an exceptional expertise. The team is successfully working together for more than 20 years. In the past, they were rewarded multiple times for their extraordinary performances.

Performance (gross in EUR)¹:

| 2024 | 2025 | 2026 | |

|---|---|---|---|

| Jan | n.a. | n.a. | n.a. |

| Feb | n.a. | n.a. | n.a. |

| Mar | n.a. | n.a. | n.a. |

| Apr | n.a. | n.a. | n.a. |

| May | n.a. | n.a. | n.a. |

| Jun | n.a. | n.a. | n.a. |

| Jul | n.a. | n.a. | n.a. |

| Aug | n.a. | n.a. | n.a. |

| Sep | n.a. | n.a. | n.a. |

| Oct | n.a. | n.a. | n.a. |

| Nov | n.a. | n.a. | n.a. |

| Dec | n.a. | n.a. | n.a. |

| Year | n.a. | n.a. | n.a. |

| from | to | Lupus alpha CLO High Yield Invest CAV | |

|---|---|---|---|

| 1 month | n.a. | n.a. | n.a. |

| 90 days | n.a. | n.a. | n.a. |

| 1 year | n.a. | n.a. | n.a. |

| 3 years | n.a. | n.a. | n.a. |

| 5 years | n.a. | n.a. | n.a. |

| this year | n.a. | n.a. | n.a. |

| since inception | n.a. | n.a. | n.a. |

| since inception p.a. | n.a. | n.a. | n.a. |

Key Statistics³:

| as of | Lupus alpha CLO High Yield Invest CAV | |

|---|---|---|

| Volatility p.a. | 30.01.2026 | 0.82 % |

| Maximum Draw Down 90 Days | 30.01.2026 | 0.00 % |

| Sharpe Ratio | 30.01.2026 | n.a. |

| Distribution | 15.12.2025 | 1.78 € |

| Modified Duration | 30.01.2026 | 0.10 |

| Ø Coupon | 30.01.2026 | 8.21 % |

| Ø Yield (YtM) | 30.01.2026 | 9.37 % |

Top ten holdings as of 30/01/2026

| % Fund | |

|---|---|

| OTRANTO PARK 25/39FLR E-R | 14.70% |

| ALBACORE V 24/38 FLR ER | 14.10% |

| MA.P E.F.XVI 21/34 FLR E | 9.00% |

| CONT.CLO VII 25/38FLR E-R | 7.70% |

| CVC FD XVIII 21/34 FLR E | 7.30% |

| CVC C.LF.XXI 21/34 F | 7.30% |

| CORD.LF XXVI 25/38 F | 7.10% |

| ST. PAUL'S X 21/35 FLR E | 6.90% |

| SP EO CLO VI 21/34 FLR F | 6.00% |

| DRYDEN 39E15 22/35 FLR E | 5.60% |

Maturity of CLO´s as of 30/01/2026

Ratingstructure as of 30/01/2026

Chances

- Provides access to the European corporate loan market.

- Enables to benefit from the high performance potential of securitized corporate loans while at the same time keeping default risks at moderate levels (mostly CLO high yield tranches with a rating of BB or B).

- By buying loans indirectly via CLOs, one can create a liquid portfolio that meets the requirements set out by UCITS.

- Low dependency to general interest rate trends.

- Ongoing coupon payments deliver regular income streams.

Risks

- Counterparty default risk: If counterparties and issuers do not fulfill or only partially fulfill their contractual payment obligations, this can result in losses for the fund. Even when securities are carefully selected, losses caused by the financial collapse of issuers cannot be ruled out.

- Concentration risk: If investment is concentrated on particular assets or markets, the fund becomes particularly heavily dependent on the performance of these assets or markets.

- Operational risk: The fund can become the victim of fraud, criminal acts or errors by company employees or external third parties. Finally, management of the fund can be negatively impacted by external events such as fires, natural disasters or similar.

- Liquidity risk: If securities are traded in a relatively narrow market segment, it can be difficult to resell them in situations where there is insufficient liquidity.

- Interest-rate risk: Changes in market interest rates can affect the prices of fixed-income securities. These fluctuations vary, however, depending on the term of the fixed-income securities.

- Market Risk: The performance of financial products depends on the development of the capital markets.

Current fund data as of 02/18/2026

Lupus alpha CLO High Yield Invest CAV WKN : A3DD2V | ISIN: DE000A3DD2V6 | |

|---|---|

Currency

| EUR |

Issue price

| 107.38 |

Redemption price

| 103.25 |

Fund volume

| 46,21 Mio. |

Launch date

| May 07, 2025 |

Minimum investment amount

| 10,000,000 |

Distribution policy

| distribution |

Portfolio managers

| Norbert Adam, Stamatia Hagenstein, Michael Hombach, Dr.Klaus Ripper |

Performance fee

| none |

Management fee

| 0.80% |

Redemption fee

| none |

Max. Initial Charge

| up to 4% |

High-Watermark

| no |

Unit price determined

| daily |

Total expense ratio (TER)

| 0.85% p.a. as of 5/5/2025 |

Unit redemption possible

| daily |

Share class

| Institutional |

Fund price publication

| |

Special characteristics7 | Partial swing pricing, redemption period of 10 days |

Current fund data as of 02/19/2026

Lupus alpha CLO High Yield Invest C WKN : A3DD2U | ISIN: DE000A3DD2U8 | |

|---|---|

Currency

| EUR |

Issue price

| 107.41 |

Redemption price

| 103.28 |

Fund volume

| 45,80 Mio. |

Launch date

| May 05, 2025 |

Minimum investment amount

| none |

Distribution policy

| distribution |

Portfolio managers

| Norbert Adam, Stamatia Hagenstein, Michael Hombach, Dr.Klaus Ripper |

Performance fee

| 15.0% |

Management fee

| 0.60% |

Redemption fee

| none |

Hurdle Rate

| 3M Euribor + 5% p.a. |

Max. Initial Charge

| up to 4% |

High-Watermark

| yes |

Unit price determined

| daily |

Unit redemption possible

| daily |

Share class

| Institutional |

Fund price publication

| |

Special characteristics7 | Partial swing pricing, redemption period of 10 days |

Total expense ratio (TER)

| 0.65% p.a. as of 5/5/2025 |

This fund information is provided for general information purposes. This information is not designed to replace the investor‘s own market research nor any other legal, tax or financial information or advice. The information presented does not constitute an invitation to buy or sell or investment advice. It does not contain all key information required to make important economic decisions and may differ from information and estimates provided by other sources or market participants. We accept no liability for the accuracy, completeness or topicality of this information. All statements are based on our assessment of the present legal and tax situation. All opinions reflect the current views of the portfolio manager and can be changed without prior notice. Full details of our funds and their licenses of distribution can be found in the relevant current sales prospectus and, where appropriate, Key Investor Information Document , supplemented by the latest audited annual report and/or half-year report. The relevant sales prospectus and Key Investor Information Documents prepared in German are the sole legally-binding basis for the purchase of funds managed by Lupus alpha Investment GmbH. You can obtain these documents free of charge from Lupus alpha Investment GmbH, P.O. Box 1112 62, 60047 Frankfurt am Main, Germany, upon request by calling +49 69 365058-7000, by e-mailing service@lupusalpha.de or via our website www.lupusalpha.de. If funds are licensed for distribution in Austria the respective sales prospectus, Key Investor Information Document and the latest audited annual report or half-year report are available from the Austrian paying and information agent UniCredit Bank Austria AG based in Rothschildplatz 1, 1020 Vienna, Austria. Fund units can be obtained from banks, savings banks and independent financial advisors.

Neither this fund information nor its contents or a copy thereof may be amended, reproduced or transmitted to third parties in any way without the prior written consent of Lupus alpha Investment GmbH. By accepting this document, you declare your consent to comply with the aforementioned provisions. Subject to change without notice.

Lupus alpha Investment GmbH

Speicherstraße 49–51

D-60327 Frankfurt am Main

- Source: Lupus alpha; gross performance (BVI method): The gross performance considers all costs incurred at Fund level (e. g. management fee) and assumes reinvestment of any distributions. Costs incurred at customer level such as sales charge and securities account costs are not included. Unless otherwise specified, all indicated performance data show the gross performance. Please note: Past per-formance is not a reliable indicator for future performance.

- Source: Lupus alpha; gross performance (BVI method): The gross performance considers all costs incurred at Fund level (e. g. management fee) and assumes reinvestment of any distributions. Costs incurred at customer level such as sales charge and securities account costs are not included. Unless otherwise specified, all indicated performance data show the gross performance. Please note: Past performance is not a reliable indicator the future performance.

- Volatility: Volatility is the range of variation of a security price or index around its mean value over a fixed period of time. A security is regarded as volatile if its price fluctuates heavily. Maximum loss 90 days: The maximum loss specifies an investor's potential loss if he had bought during the past 90 days at the highest price and sold at the lowest price. VaR 95 – 10: Value at Risk defines the level of loss which will not be exceeded within 10 days with a probability of 95%. VaR 99 – 10: Value at Risk defines the level of loss which will not be exceeded within 10 days with a probability of 99%. Sharpe Ratio: Sharpe Ratio is the excess return (Fund performance less money market rate) in relation to the range of variation (volatility) and shows the yield of the Fund per risk unit. The higher the Sharpe Ratio, the more yield has been generated in relation to the risk incurred.

- (**) swing pricing is a method of calculating share prices that attribute transaction costs from issues or redemptions directly to whom initiated those transa ctions. For partial swing pricing, this method is only used if issues and redemptions cause a specific amount of surpluses that exceed a pre-determined threshold on a given valuation day. This causes an adjustment of the NAV either upwards or downwards (swing factor). The company determines this threshold as an fractional value based on market conditions, liquidity and risk evaluations.