Frankfurt, January 25th, 2021: Lupus alpha Micro Champions (LU1891775857), which invests in small-cap European companies, achieved the highest outperformance since its launch over the past year, beating its benchmark index by almost 24%. The mutual fund ended 2020, the year of the coronavirus crisis, up 32.5% overall. The fund profits from its positioning in companies that address structural growth issues – and thus trends that have intensified further during the coronavirus crisis, such as digitalisation, working from home and e-commerce. Portfolio manager Jonas Liegl has also focused the portfolio more strongly on European stocks, while the proportion of equities from German-speaking countries has fallen significantly.

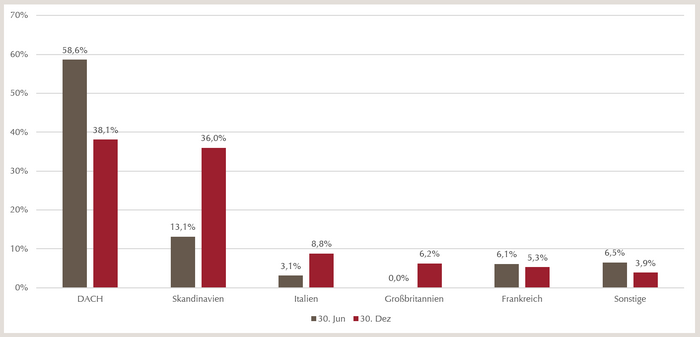

Lupus alpha Micro Champions focuses on companies in the pan-European region whose market capitalisation is below EUR 750 million at the time of the initial investment – a segment with around 1,500 individual securities. Many of these companies are in an early phase of growth, their business model has proven to be a success, and their growth potential is predicted to be above average. While this focus remains unchanged, Jonas Liegl has significantly adjusted the regional distribution of stocks within the fund since becoming portfolio manager on 1 July 2020. The weighting of Scandinavia has almost trebled to 36%. The United Kingdom, not previously represented in the portfolio, now has a weighting of 6%. As part of this reconfiguration, the proportion of stocks from German-speaking countries (the DACH region) has fallen from just under 59% to 38%.