Topics and markets Q3/2025

Time for the All-Weather Jacket

![[Translate to English:] Dr._Goetz_Albert](/fileadmin/_processed_/9/e/csm_Dr._Goetz_Albert_1_b75c5b90f5.jpg)

Global equity markets are at record highs. In the U.S., the S&P 500 and Nasdaq 100 have both reached new peaks, as has Japan’s Nikkei. Even the DAX hit an all-time high just a few days ago. While investors have benefited from this rally, concerns about a potential bubble are growing. The main driver of this trend is the ongoing euphoria surrounding artificial intelligence – yet the companies seen as its biggest beneficiaries still need to prove that their future earnings can justify today’s lofty valuations.

Bubble or not, investors would be wise to diversify broadly in today’s risk-laden market environment and make their portfolios “weatherproof” by complementing equities and bonds with alternative investment solutions offering attractive returns. One alternative currently stands out in particular: convertible bonds are experiencing a renaissance, both in terms of performance as well as market activity.

Yours

Dr. Götz Albert, CFA

Partner and Chief Investment Officer

Taking Advantage of Crises with Long/Short Strategies

So far this year, there has been no shortage of market-moving events. The announcement of Germany’s special funds and infrastructure packages initially triggered a strong rally in European equity markets. Later, Trump’s tariff announcement on “Liberation Day” sparked global panic, which eased again after subsequent bilateral trade agreements.

While such market fluctuations can be endured by investors with sufficient volatility tolerance, they often coincide with fundamental – sometimes structural – shifts within specific sectors and companies that have lasting effects on their revenues and earnings, both to the upside or downside.

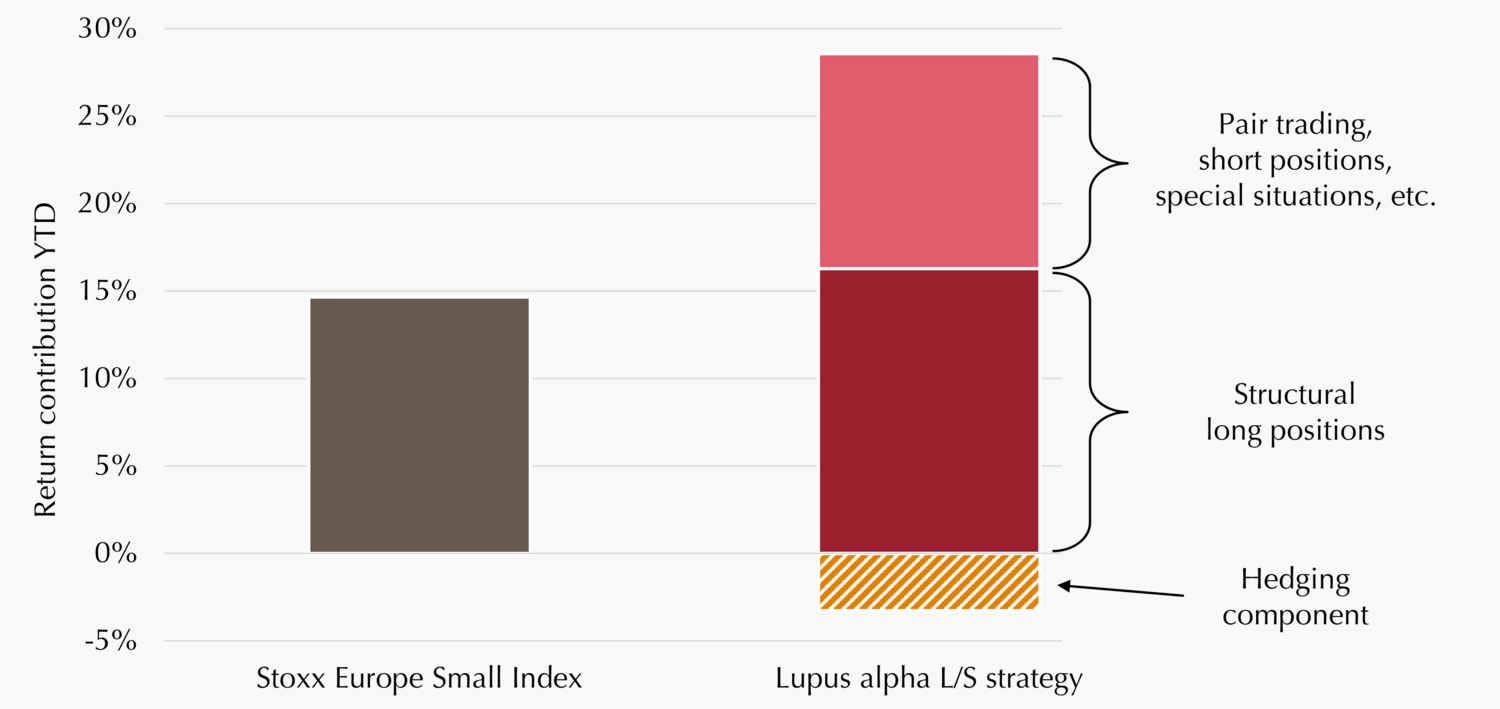

At the beginning of the year, for example, German defense and infrastructure stocks were booming, whereas companies with high U.S. exposure came under significant pressure in April. Long/Short equity strategies can not only cushion such developments but, with the right positioning, even profit from them. In the current environment, a Long/Short strategy focused on European small and mid caps has significantly outperformed Long Only strategies – benefiting not only from positive market trends and successful stock selection but also from short positions and short-term trading opportunities (see chart).

Moreover, systematic market risks can be mitigated through additional hedging components. For instance, implementing a “short futures position” can help reduce potential portfolio losses caused by overall market drawdowns rather than company-specific factors. While this slightly reduces returns during bull markets, it can significantly lower portfolio volatility and drawdowns.

Long/Short strategies in the small and mid-cap segment thus combine the dynamism of high-growth companies with a risk-controlled approach that can capitalize on short-term or structural weaknesses in individual firms or on general market fluctuations. In consequence, they are able to generate market-independent returns.

Franz

Führer

Partner, Portfolio Management Small & Mid Caps Europe

Björn

Wolf

CFA, CESGA, Portfolio Management & Research Small & Mid Caps Europe

Not Just Performance Is Booming in 2025

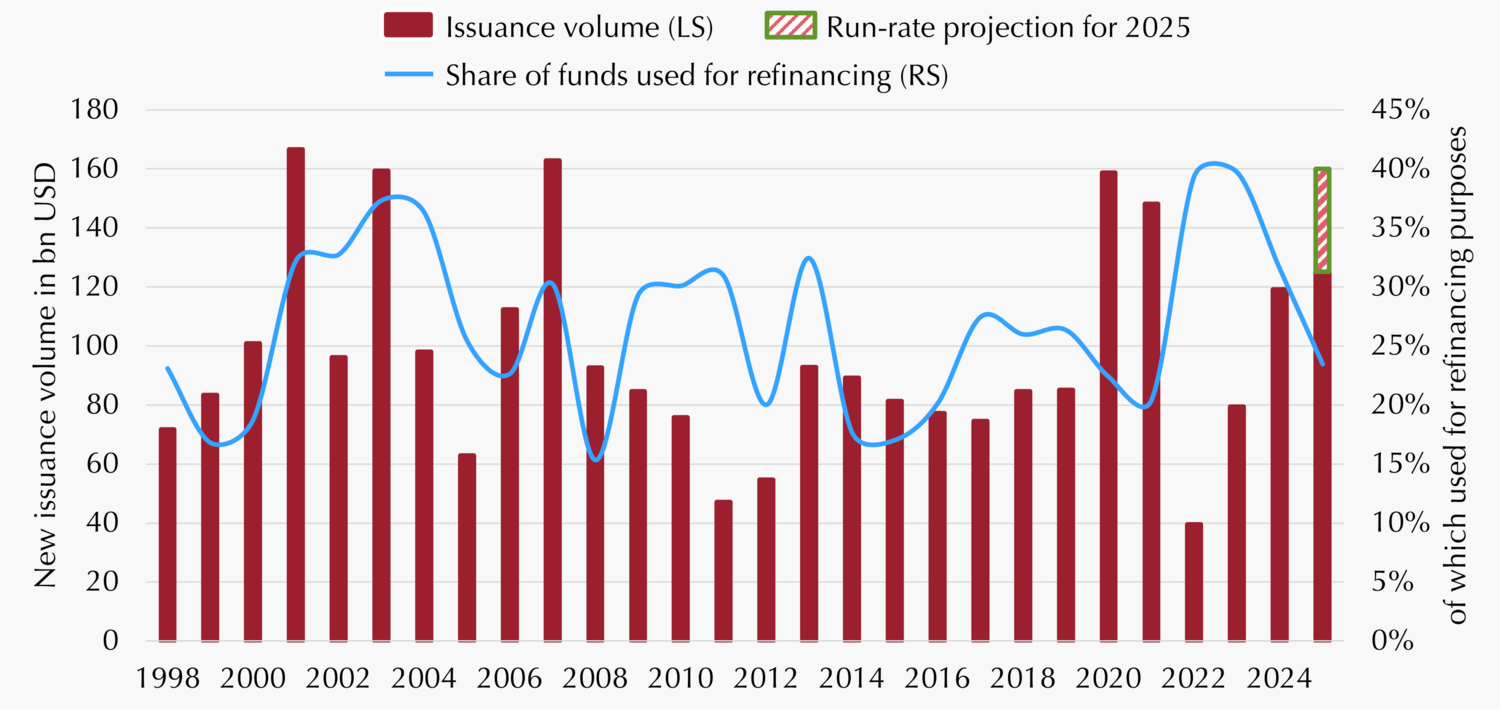

The strong performance of convertible bonds has once again highlighted the potential of this asset class. In addition to rising prices, investors can now welcome another positive development: issuance volumes have reached record levels this year. As a result, the investable universe for fund managers has expanded significantly, offering a much broader range of opportunities. However, with greater opportunity also come potential risks and pitfalls that must be carefully managed.

A key advantage of this larger universe is its inclusion of issuers from a variety of innovative sectors. For example, recent convertible bond issues from Nebius Group, a Dutch provider of artificial intelligence infrastructure, and Iren Ltd., a supplier of climate-friendly AI data centers, reflect current megatrends beyond the familiar names like Nvidia & Co.

Compared to the challenging years of 2022 and 2023, there is also a positive shift in how proceeds of the issuances are being used. Whereas many companies previously sought convertible bonds as an urgent refinancing tool amid rising interest rates, a growing share of issuers are now deploying the funds to expand their business models (see chart).

That said, there are also development that should be analyzed carefully. Around 50% of this year’s convertible bond issues carry a zero coupon – which in itself does not imply a poor deal, but still warrants careful scrutiny of the individual terms and issuer quality. Assessing the relative opportunities and risks of such issues versus traditional fixed-income instruments is a key task for active managers.

The wave of new issuance therefore creates ideal conditions for active positioning aligned with each fund’s investment profile – from defensive approaches to balanced strategies and more opportunity-oriented mandates, including those with crypto exposure.

Marc-Alexander

Knieß

Portfolio Management Global Convertible Bonds

Stefan

Schauer

Portfolio Management Global Convertible Bonds

Manuel

Zell

CESGA, Portfolio Management Global Convertible Bonds

EU Opens New Yield Opportunities for Insurers

The long-awaited reform of the EU Securitisation Regulation gained momentum this year. Major investment projects in infrastructure, digitalization, and defense require not only government fiscal packages but also private capital. To unlock additional funding, the reforms aim to strengthen the securitisation market. While the final version of the EU Commission’s new regulation is still pending, consultations so far have already revealed the general direction.

For banks, no significant changes to capital and liquidity requirements are planned. However, for Solvency II-regulated investors – i.e. insurance companies – the reform appears to create new, attractive investment opportunities. Increasing allocations by this large investor group towards asset-backed securities (ABS) will provide additional room for new loan origination.

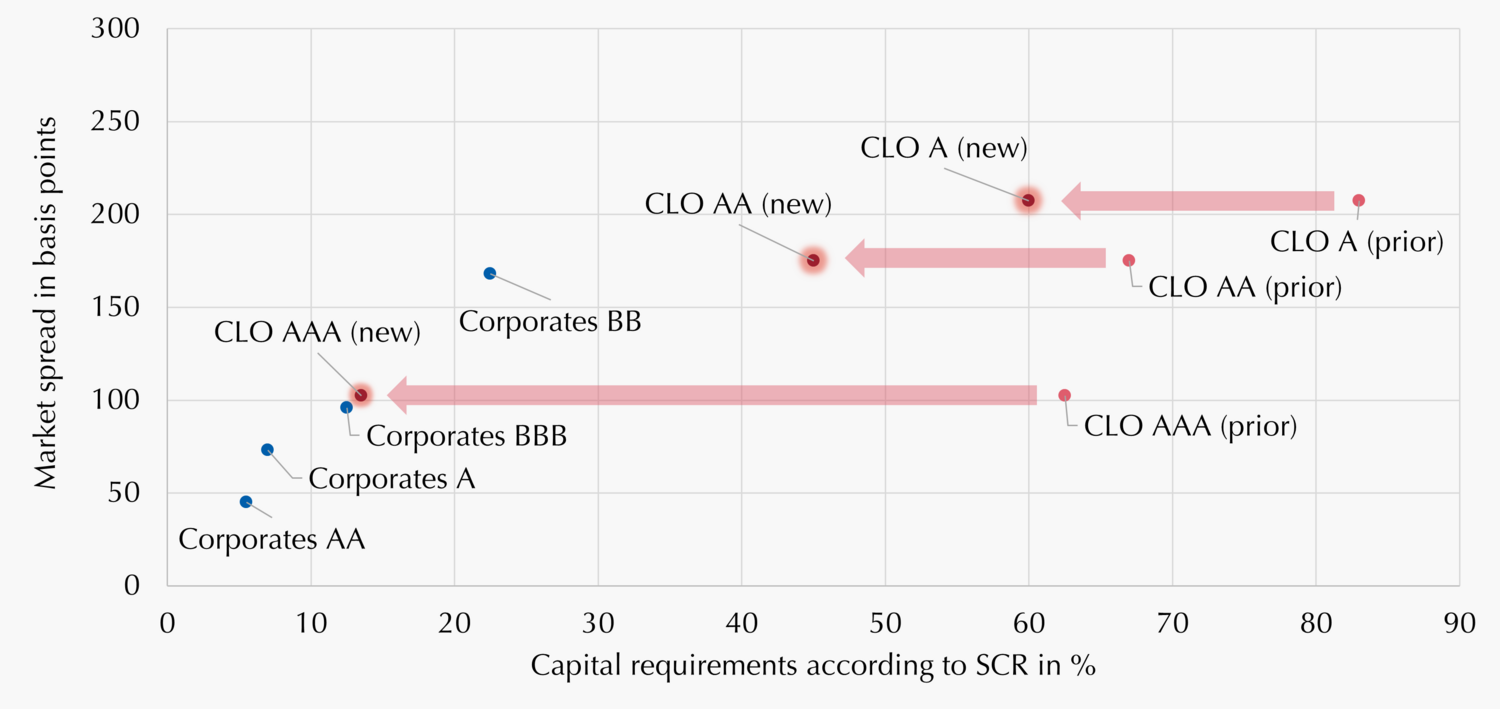

For CLOs, the consultations indicate significantly lower capital requirements for Solvency II-regulated investors across all rating classes. This opens up new opportunities for insurers, particularly in the high-quality AAA and AA segments, while lower-rated tranches remain unattractive from a regulatory perspective despite these reductions (see chart below).

Specifically, under the standard approach, AAA CLO tranches with a five-year duration would face capital requirements of 13.5% instead of the previous 62.5%.[1] As a result, the return on regulatory capital rises from just over 5% to around 25%. From a regulatory perspective, this dramatically improves their attractiveness relative to traditional corporate bonds. Moreover, they offer a significantly higher absolute yields: AAA CLO tranches currently yield about 3.4%, whereas such yield levels in corporate bonds are only available at BBB ratings or lower – with correspondingly higher default risk.

Higher Yield on Regulartory Capital for High Quality CLO Tranches

Capital requirements according to EU’s consultation from July 10th 2025 based on the assumption of a time to maturity of 5 years. Source: European Commission, Morgan Stanley, JP Morgan, Bank of America, Lupus alpha, own calculations. As of: 30.09.2025.

Dr.

Klaus

Ripper

Portfolio Management Fixed Income Credit

Stamatia

Hagenstein

Portfolio Management Fixed Income Credit

Diversifying Across Volatility Risk Premia Pays Off

The volatility risk premium (VRP) has been a stable and economically sound source of returns for decades, rooted in a fundamental risk transfer within capital markets. It originates from the behavior of risk-averse investors seeking to hedge their portfolios against sharp market declines.

The resulting imbalance – with many buyers but few sellers/providers of protection – causes options to be structurally “overpriced.” For volatility funds, this creates an attractive, systematically exploitable source of return that also enhances overall portfolio diversification.

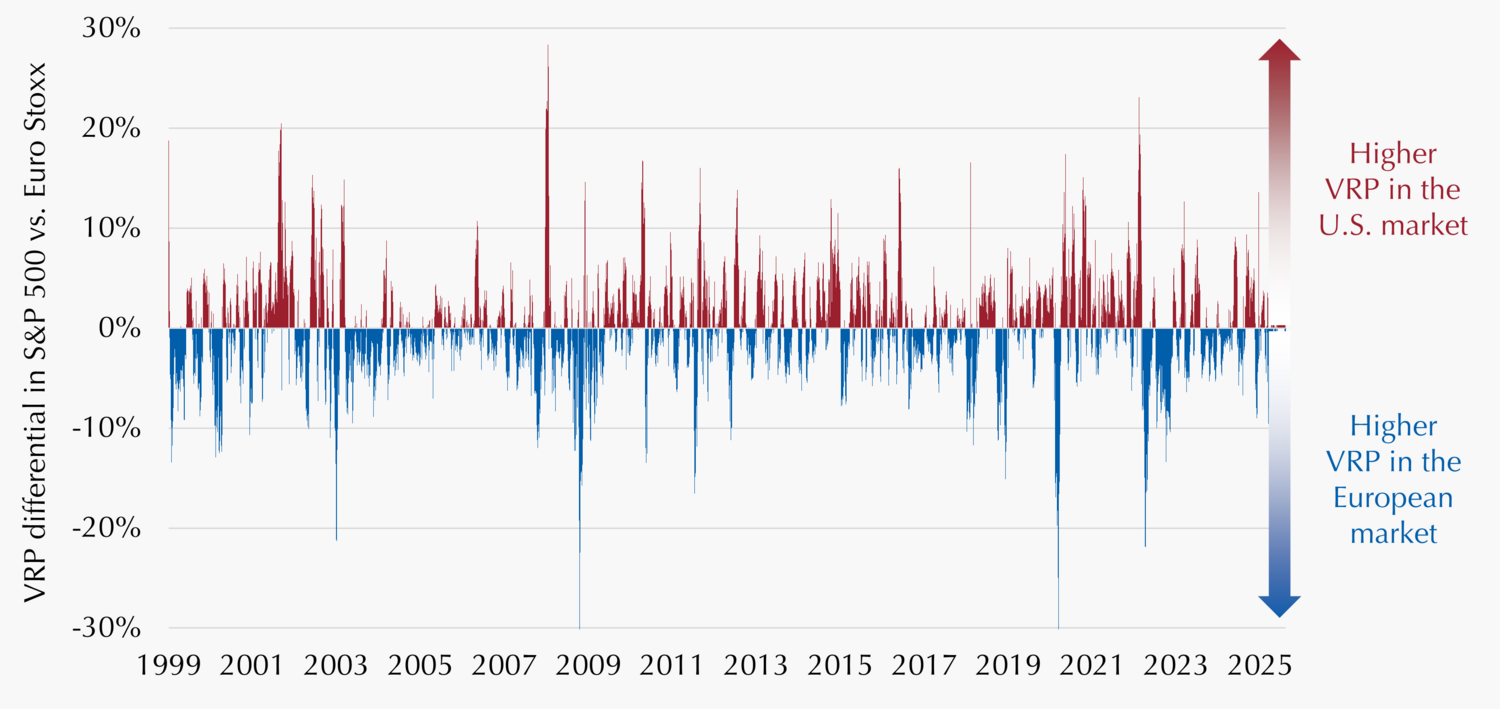

Many volatility strategies focus on capturing the VRP in the U.S. – a market with a long history and significant depth. However, the VRP is not an exclusively American phenomenon. The same investor behavior can be observed and utilized in Europe and other regions, offering additional diversification potential within volatility strategies.

A look back over the past 25 years reveals marked differences in how the VRP has manifested between major markets such as the U.S. (S&P 500) and Europe (Euro Stoxx 50). These differences appeared both in periods of generally positive VRP – where one region showed higher absolute levels – as well as during crisis phases with strongly negative VRP. For instance, during the COVID-19 crash in 2020 or after Trump’s tariff announcements in April 2025, the VRP in the Euro Stoxx 50 was significantly less negative than in the U.S. market. Recovery phases also tended to differ between regions, reflecting variations in supply and demand dynamics or differing investor perceptions regarding the speed of market normalization.

Targeted harvesting of the VRP across multiple regions therefore represents an effective way to achieve diversification across volatility markets – helping to make portfolios more robust and resilient overall.

Mark

Ritter

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Every Percentage Point of Avoided Loss Counts!

Global passive equity ETFs are often seen as a convenient way to achieve broad, diversified exposure to global equity markets. However, these ETFs fully replicate market performance – which is advantageous during bull markets but disadvantageous during downturns, as losses are equally reflected.

History shows that even broadly diversified equity portfolios have suffered losses of well over 50% during major crises. Such drawdowns are not only psychologically taxing but also severely constrain long-term performance potential. A 50% decline, for instance, requires a subsequent 100% gain just to recover to the starting level. Effective risk management is therefore essential in equity investing.

This is precisely where derivative-based capital protection strategies come into play. More offensive, equity-oriented approaches aim to capture the upside potential of global equity markets while simultaneously limiting downside risks. Options provide the crucial advantage of “automatically” adapting to changing market conditions. This allows for portfolio constructions that cap losses during crash phases while benefiting disproportionately from recoveries. Every percentage point of loss avoided means a larger capital base after a downturn which in turn enhances the long-term compounding effect. By reducing drawdowns in crisis periods, such strategies can even outperform pure equity investments over the long run.

In the current market environment – characterized by high valuations, concentration risks, and persistent geopolitical and macroeconomic uncertainties – capital protection strategies offer an attractive, risk-controlled alternative. They allow investors to stay invested and seize opportunities without constantly fearing major setbacks. This helps mitigate timing risks and enables investors to navigate market challenges with greater composure.

Stephan

Steiger

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

The Many Faces of Derivatives

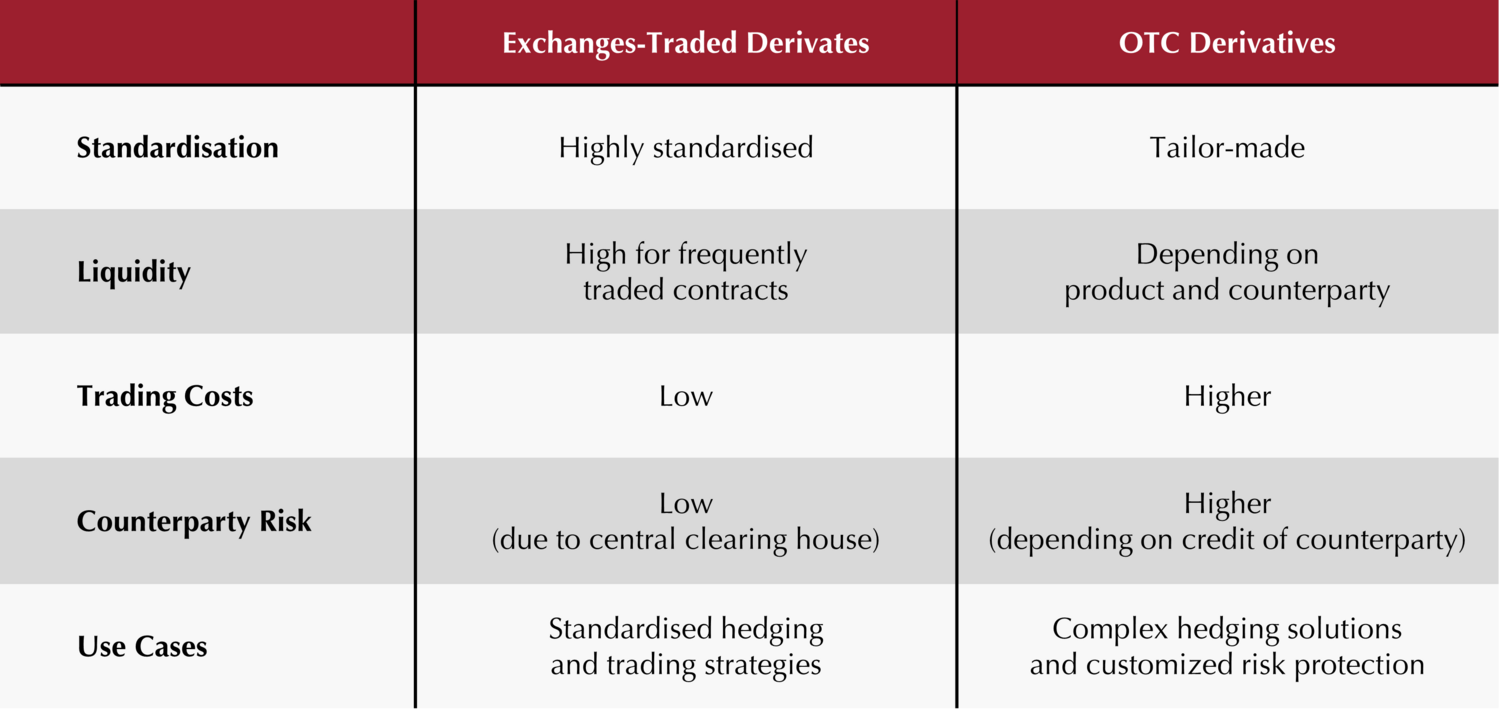

Designing a risk overlay that fits the needs of institutional investors requires tailored solutions, a broad range of instruments, and extensive experience. When trading derivatives, one key factor to consider is counterparty risk – the risk that the opposing party in a contract might fail to meet its obligations. In this context, a fundamental distinction is made between exchange-traded and so-called over-the-counter (OTC) derivatives.

Exchange-traded derivatives, such as futures and options, are highly standardized, which ensures high liquidity and relatively low transaction costs. They are traded on organized exchanges, meaning that buyers and sellers do not enter into direct contracts with each other. Instead, a central counterparty (CCP) steps in between them. One well-established CCP for financial derivatives is Eurex Clearing. The CCP acts as the buyer to all sellers and as the seller to all buyers. This structure significantly reduces counterparty risk, as the CCP enforces strict risk management standards, minimizes default and settlement risk, and ensures adequate collateralization. Thanks to these mechanisms, counterparty risks in exchange-traded derivatives are minimal. For transactions in established and liquid markets, exchange-traded derivatives are therefore often the preferred choice.

OTC derivatives, on the other hand, are negotiated bilaterally – examples include credit default swaps (CDS) or forward contracts on currencies (FX forwards). These instruments are customized and can be flexibly tailored to specific needs in terms of size, underlying, or maturity. OTC derivatives enable precise hedging but often come with higher costs and lower liquidity. Even though collateral and margining arrangements are typically in place, counterparty risk generally remains higher than in exchange-traded products. Managing OTC derivatives therefore requires specialized expertise – from contract structuring and pricing to assessing liquidity and counterparty risks.

Marvin

Labod

Head of Quantitative Analysis

Alexander

Raviol

Partner, CIO Derivative Solutions