Topics and markets Q2/2025

Robust Equity Markets – But for How Much Longer?

![[Translate to English:] Dr._Goetz_Albert](/fileadmin/_processed_/9/e/csm_Dr._Goetz_Albert_1_b75c5b90f5.jpg)

After several U-turns by the U.S. President on tariff policy, the end of the 90-day tariff truce had lost much of its initial threat for many market participants. Accordingly, the markets reacted rather calmly to the announced measures by the U.S. government towards countries like South Korea and Japan. The postponement of the decision on future trade policy with Europe – which is much more important to global markets – was also interpreted by investors as a positive signal and the final agreement reached in July at least provided investors with some clarity on future tariff rates.

However, this deal and the current robustness of markets should not distract from the ongoing geopolitical and economic uncertainties. While some uncertainties regarding tariff rates seem to be resolved, their effects on economic growth remain unclear at this point. Furthermore, another escalation on the scale of a "Liberation Day" remains a possibility at any time.

This is all the more reason for investors to position themselves across asset classes and diversify their portfolios beyond equities and bonds by including alternative investment solutions. With the right portfolio components, attractive returns can be achieved even in uncertain, low-growth economic phases.

Yours

Dr. Götz Albert, CFA

Partner and Chief Investment Officer

Record Inflows into German Small & Mid-Caps

The proposed investment package of the new German government has led to renewed confidence and interest in German equities, in particular towards small and mid-caps. Although the fundamental effects of spending plans will take time to become visible in corporate balance sheets over the coming months and years, the positive impact on investor sentiment in the capital markets is already evident.

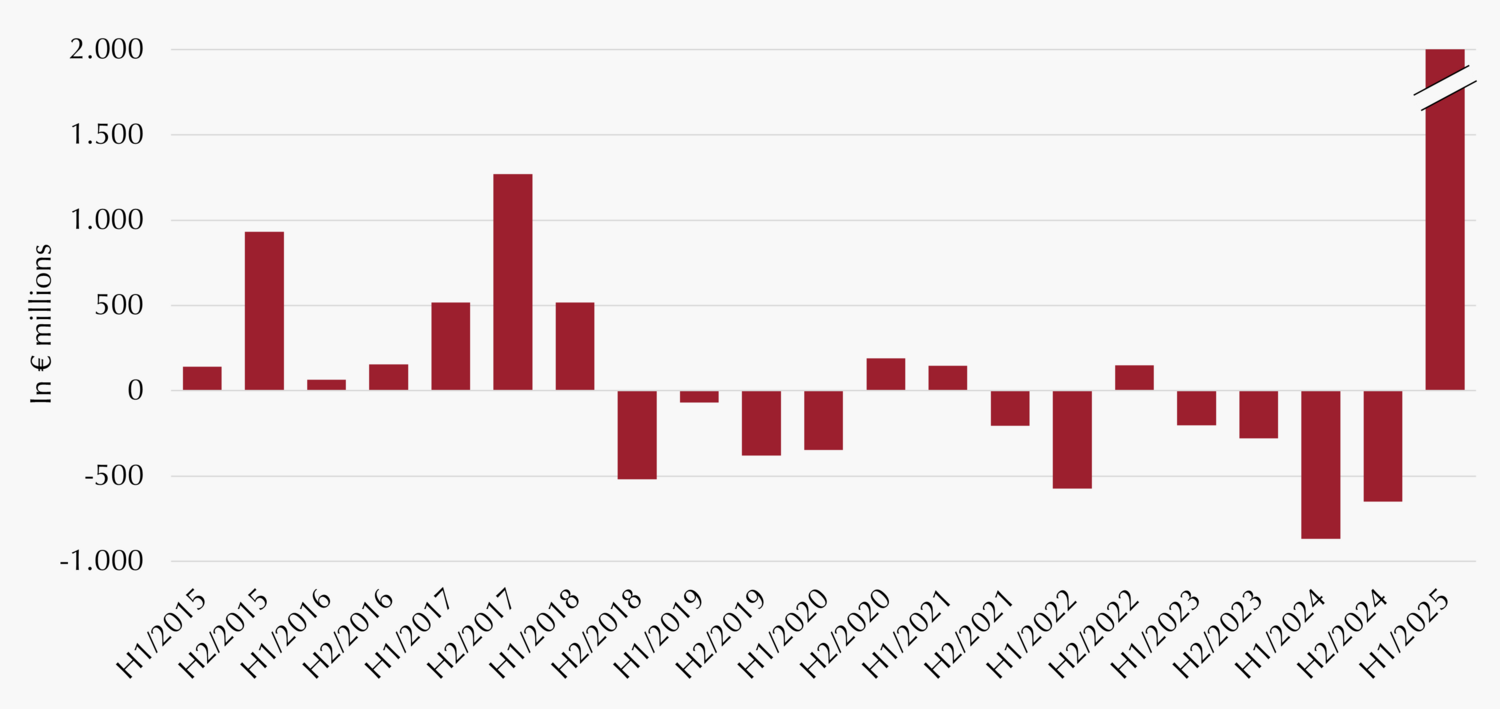

According to our analysis of various fund databases, funds focused on German equities have recorded net inflows of nearly €6 billion since the beginning of the year. This highlights the positive expectations of market participants regarding the future business performance of German companies, after years of rather negative sentiment.

What stands out is how strongly investors view the new fiscal measures as a booster for Germany's so-called “Mittelstand” (small and medium-sized enterprises). In both the first quarter and the April-May period, German small and mid-cap funds attracted more inflows than large-cap equity funds. Since the beginning of the year, net inflows totaled €3.0 billion and €2.6 billion, respectively. Given the significantly smaller fund volumes in the small and mid-cap segment, these figures are nothing short of spectacular. They represent record inflows into German small and mid-caps – which have never been seen to this extent before.

The reasons for this shift in investor sentiment are multifaceted. In addition to increased infrastructure and defense spending, the significantly improved business climate is likely to have played a role. The Ifo Business Climate Index increased for the sixth consecutive month in June. While this may seem surprising considering the global trade conflict that flared up in April, it highlights the expected effectiveness of the fiscal programs.

Moreover, the trade escalation initiated by U.S. President Trump has led many investors to reassess their U.S. allocations. The resulting reallocations to Europe have particularly benefited German small and mid-caps, which have already gained nearly 24% in value since the start of the year – and are likely to have further upside potential.

Björn

Glück

CFA, Partner, Portfolio Management Small & Mid Caps Europe

More Than Just a Mix of Equities and Bonds

The first half of 2025 has known few winners with lasting performance. Although global equities got off to a promising start into the year, the long-standing global equity rally came to an abrupt halt with Donald Trump's “Liberation Day.” As a result, global stock markets declined by up to -17%. Bonds fared somewhat better amid the ensuing market turmoil, but they never offered truly attractive returns.

Convertible bonds, often described as a hybrid of equities and bonds, told a very different – and much more positive – story. After a strong performance in the previous year (+7.6%), they were able to demonstrate their strengths even in the current challenging market environment, outperforming traditional 60/40 portfolios. Global convertible bonds not only delivered a return of over 6% in the first half of 2025, but they also proved far more resilient during the April drawdown.

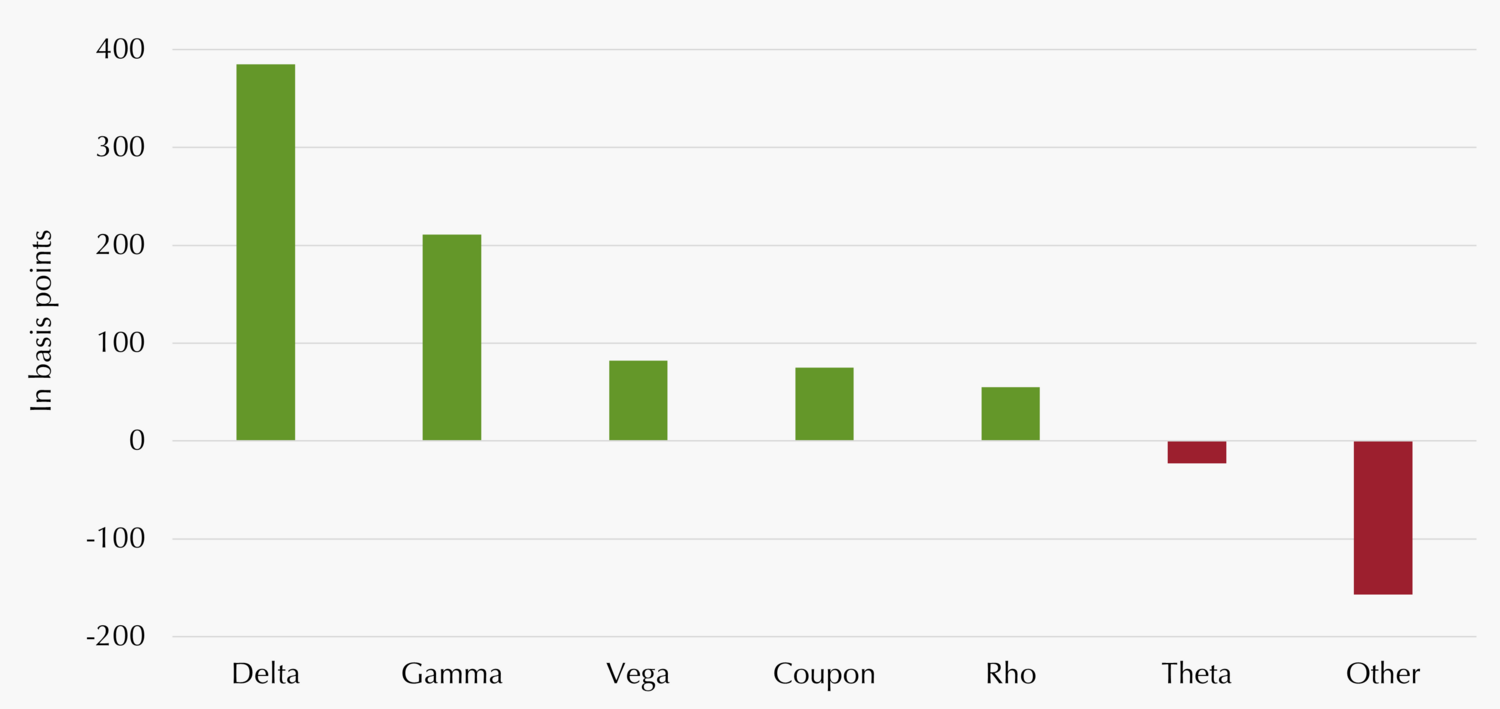

What explains this decoupling? A first look at the performance drivers points to a significant delta effect. This is particularly positive given the composition of the convertible bond universe, which is less U.S.-centric (compared to broad equity indices such as the MSCI World). As a result, convertibles benefited more from the strong performance of European stocks – especially small and mid-caps.

The chart below also shows that almost all performance contributors of convertible bonds were positive. Even increased market volatility had a positive impact through the options component (vega effect). Additionally, changes in equity participation (i.e. changes in delta) over time also added value (gamma effect). Unlike traditional mixed portfolios, which require active positioning between asset classes, convertible bonds benefit from an “automatic asset allocation”: when equity markets rise, the delta increases, boosting participation in equity upside; when markets fall, the delta naturally decreases, helping to reduce losses. This once again underlines that convertible bonds are much more than just a simple mix of equities and bonds.

Performance contributors of convertible bonds 2025 YTD

Performance contributors of Refinitiv Global Focus Hedged Convertible Bond Index (EUR) from December 30th 2024 to June 30th 2025. Source: Refinitiv, Lupus alpha. Own calculation and illustration. As of: June 30th 2025. Past performance is not a reliable indicator for the future performance.

Marc-Alexander

Knieß

Portfolio Management Global Convertible Bonds

Stefan

Schauer

Portfolio Management Global Convertible Bonds

Manuel

Zell

CESGA, Portfolio Management Global Convertible Bonds

Achieving Equity-Like Returns Through the Right Positioning

After discussing CLO equity in our previous issue, this edition focuses on the rated CLO segment – specifically the debt tranches senior to equity within the capital structure. These debt tranches are divided into investment grade (IG) and high yield (HY) categories.1

While many institutional investors are limited to IG tranches due to regulatory constraints, those without such risk-based restrictions can generate significant excess returns in the HY CLO segment. Historically, BB tranches have offered spreads roughly twice as high as those in the BBB space.

However, unlocking this potential depends on the right positioning within the HY segment. The seemingly small difference between BB and B tranches can have a significant impact depending on the economic cycle, as these lower-rated tranches are more sensitive to events in the loan market. Even a moderate deterioration in credit conditions can lead to downgrades for single-B tranches or a deferral of interest payments to them (though this does not imply a loss of principal).

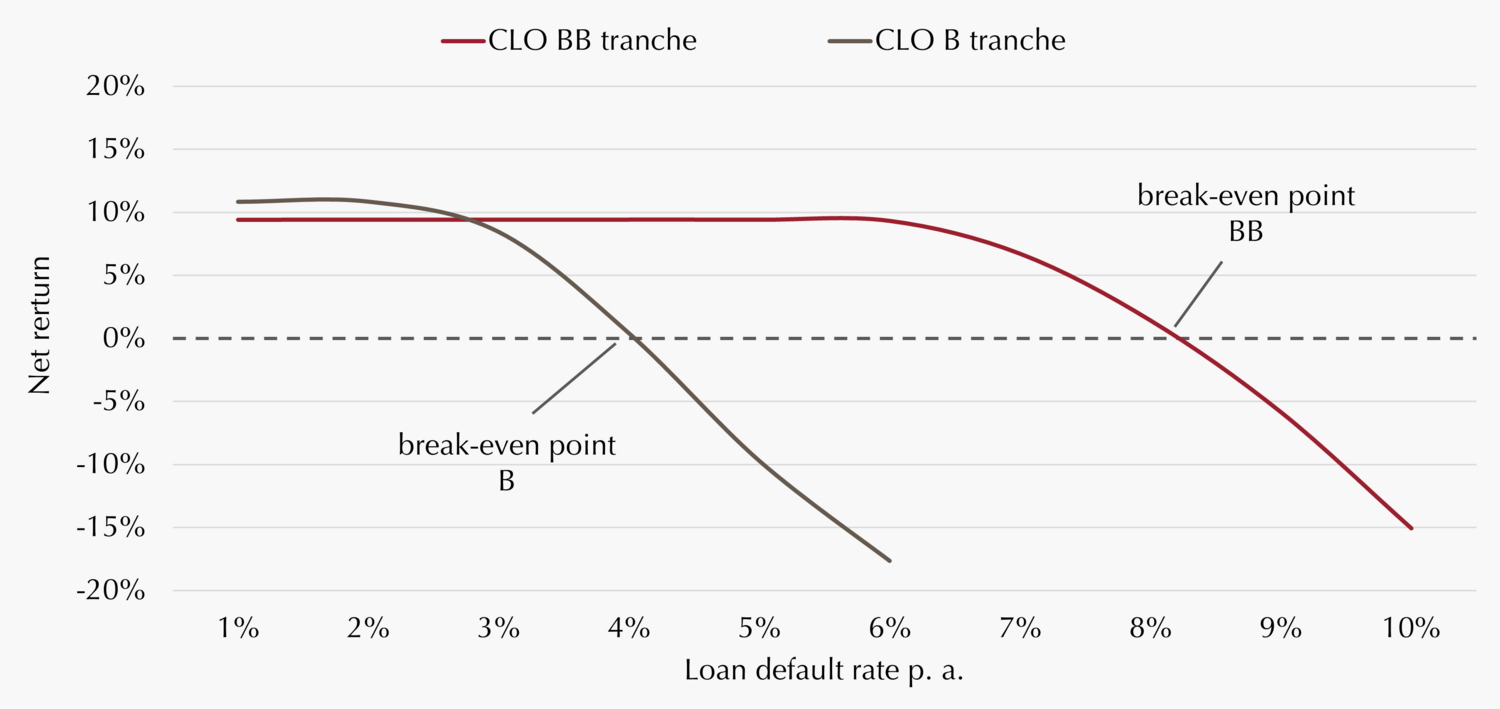

The chart below illustrates the loan default rates at which the “break-even” point is reached for CLO BB and B tranches. While an annual loan default rate of around 4% would largely erode returns for B tranches over time, the return profile of BB tranches would remain unaffected under such a scenario. Actual default rates are currently much lower, but heightened geopolitical uncertainty calls for a more cautious positioning. If default rates were to rise to 2.5–3.0% in 2025 (as forecasted by Fitch2), we would favour BB tranches due to their more stable risk profile.

With current BB spreads of around 600 basis points, investors can achieve attractive yields of approximately 8%. Even in a scenario of default rates well above historical averages, these returns would be preserved. For yield-focused yet risk-aware investors, selecting an experienced fund manager – with expertise in rating allocation and CLO manager selection – is key to long-term investment success

Returns of CLO BB and B tranches in relation to loan default rate (stress test)

Stress test results for a CLO BB and B tranche, respectively, for illustrative purposes. Assumptions: 15% Constant Prepayment Rate (annual rate of loans that are repaid earlier), 50% loan recovery rate, 6 monate default lag (period between payment default and reinvestments of recovery value). Reinvestment of loans are assumed at a price of 99% with a coupon spread of 3.5% and a time to maturity of 5 years. Source: Lupus alpha.

Norbert

Adam

Portfolio Management Fixed Income Credit

Stamatia

Hagenstein

Portfolio Management Fixed Income Credit

The Darkest Hour Is Just Before Dawn

The tariff announcements made by U.S. President Donald Trump triggered a major sell-off in the capital markets in early April which, in their original form, would have effectively marked the end of global free trade. Volatility surged to levels last seen at the start of the COVID-19 pandemic.

Although the trade escalation has since receded somewhat – first due to the 90-day negotiation pause, then due to the reached agreements with the EU and the UK – and the Middle East conflict has cooled a bit, the extreme spike in volatility in early April left its mark, particularly on investors of short-volatility strategies.

Many such strategies – whether or not they include delta exposure (see previous issue Keeping a cool head is key | Lupus alpha) – were hit at their most vulnerable point: realised volatility significantly exceeded what markets had previously priced in. As a result, the drawdowns were substantial.

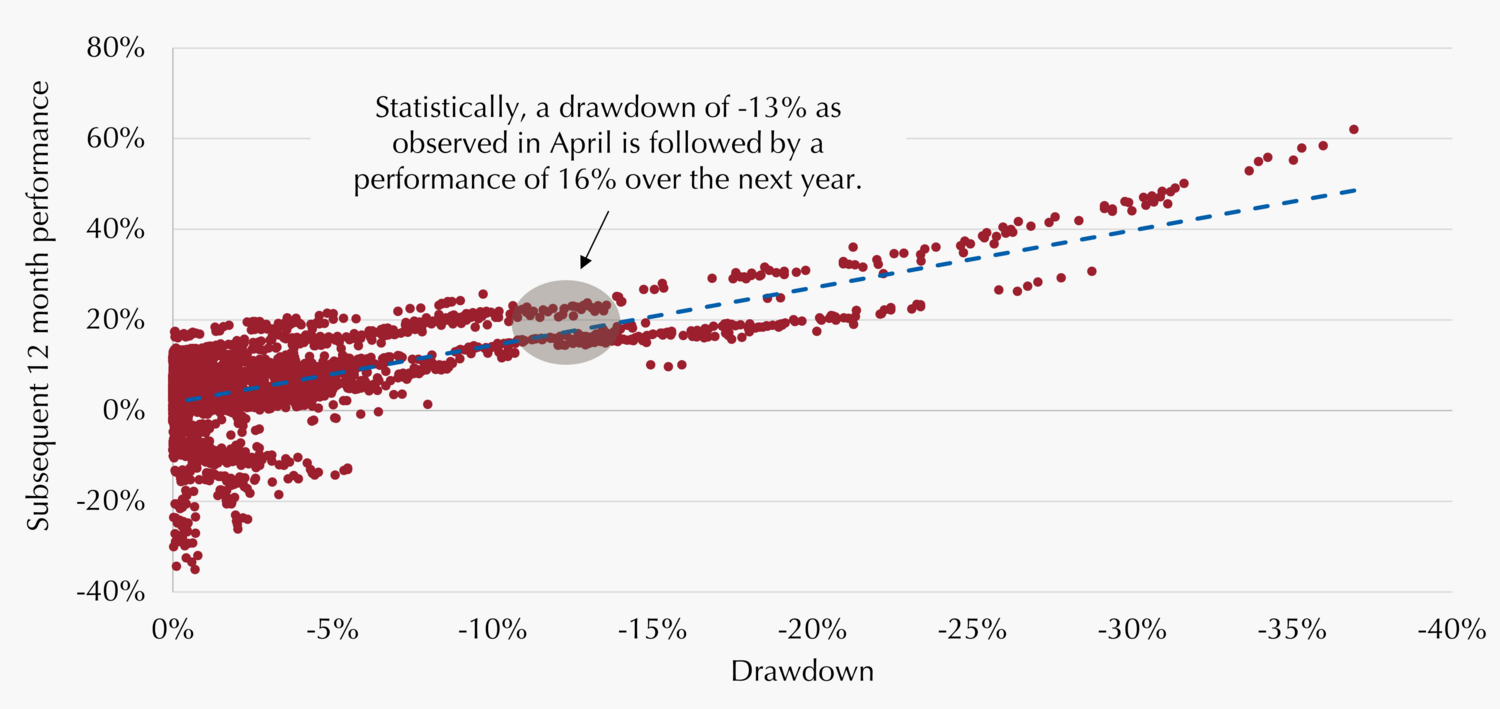

However, it is precisely at moments like these that investors should look ahead. Our analysis shows a strong correlation between drawdowns and subsequent performance (see chart). The larger the loss in short-volatility strategies (i.e. the greater the deviation between realized and implied volatility), the stronger the subsequent rebound tends to be. In fact, this relationship appears to become even more pronounced with increasing drawdowns.

Importantly, this is more than just a historical correlation or a simple market recovery. The particularly high returns following such events are also fundamentally supported by theory: during stressful phases like in early April, panic-driven market participants seek protection, driving up demand for insurance. At the same time, supply is limited – resulting in especially high premiums. “Volatility sellers” who stick to their disciplined approach can benefit by continuing to sell “insurance” at elevated volatility levels and consequently profiting from the increased premiums.

Mark

Ritter

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

“Liberation Day”? No Problem.

The second quarter began with a massive shock for equity investors, triggered by U.S. President Donald Trump’s so-called “Liberation Day.” The resulting panic led to sharp losses across global equity markets – including the previously celebrated “Magnificent 7”.

Since then, however, markets have largely recovered and returned to the levels reached at the end of the first quarter. However, offensively positioned investors had to endure interim losses of more than -17% (MSCI World), while more conservative investors often missed out on the subsequent rally.

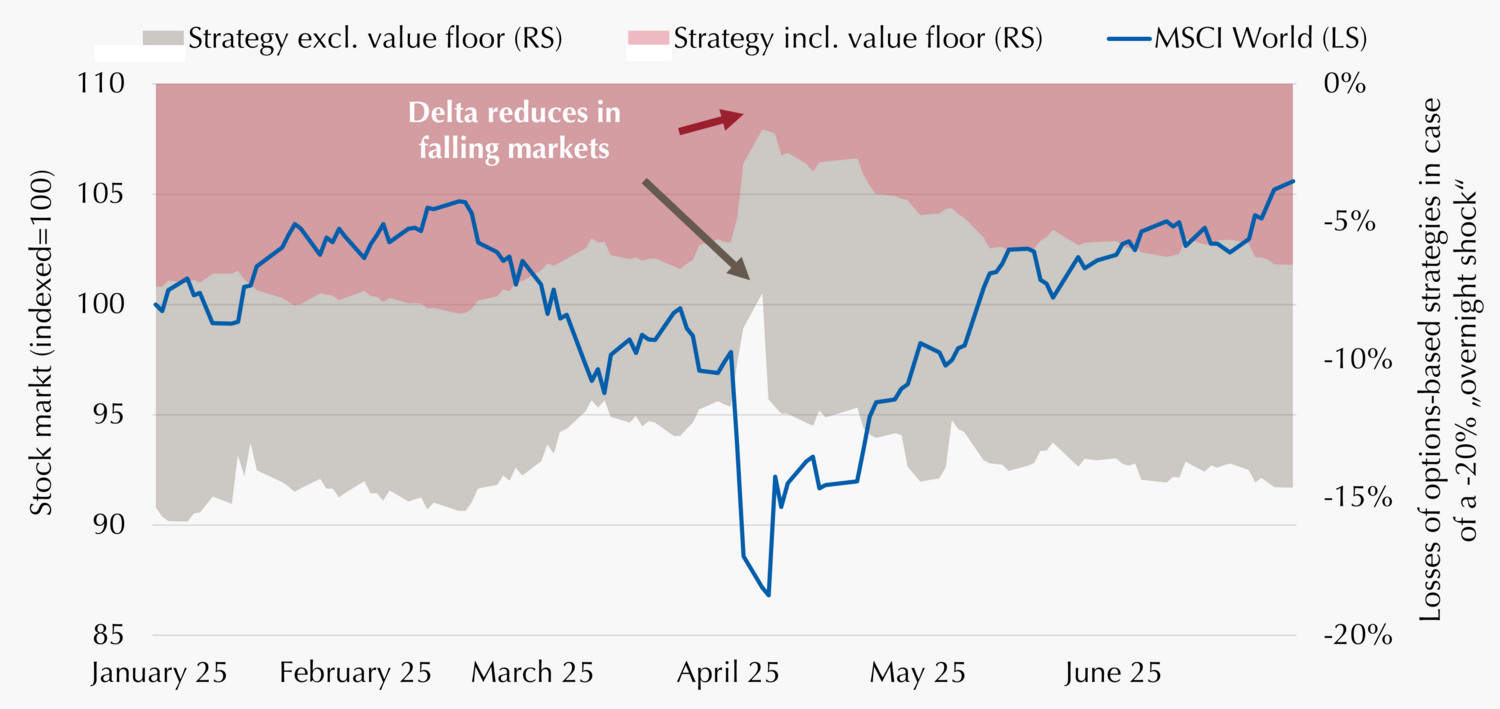

This trade-off can be mitigated by intelligent, options-based value protection strategies, which have convex payoff profiles. These strategies ensure that participation in market movements automatically adjusts – rising in bullish phases and falling in bearish ones.

The chart below illustrates how different protection strategies would have performed in the first half of the year in the event of a hypothetical overnight market shock of -20%. The more defensive strategy, which incorporates a strict capital protection floor, structurally carries a lower delta than the more aggressive variant without such a floor. During the market drop in April, its delta fell to just 8%, meaning another -20% equity decline would have translated into a loss of only around 2% in the strategy. Even the more aggressive strategy was able to cut the April drawdown by 20% – with the advantage of a stronger participation in the subsequent recovery which led in turn to a year-to-date (YTD) performance equal to long-only portfolios.

Value protection strategies therefore offer investors a valuable building block for reducing drawdowns without having to give up their exposure to the equity markets. The degree of protection or participation can be scaled according to individual risk tolerance and return objectives. And although Trump’s “U-turn” on China has somewhat defused the trade conflict, further (trade) tensions – associated with high market volatility – remain a realistic scenario in the second half of the year.

Market development and equity exposure for value protection strategies of varying scale

Expected participation of Lupus alpha‘s value protection strategies (with and without value floor, respectively) in a hypothetical market downturn of -20% overnight. MSCI World = MSCI World 100% Hedged to EUR Index. Source: Bloomberg, Lupus alpha. As of: June 30th 2025. Past performance is not a reliable indicator for the future performance.

Stephan

Steiger

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Hedging Extreme Risks – Effectiveness and Efficiency Required

Investors differ widely in their willingness to tolerate losses. While retail investors with long investment horizons often have little issue with interim fluctuations in their equity portfolios, institutional investors – especially those subject to regulatory risk constraints – tend to be far more risk-averse. However, most investor types have one thing in common: during periods of severe, broad-based short-term drawdowns, nearly all of them begin to question their risk allocation.

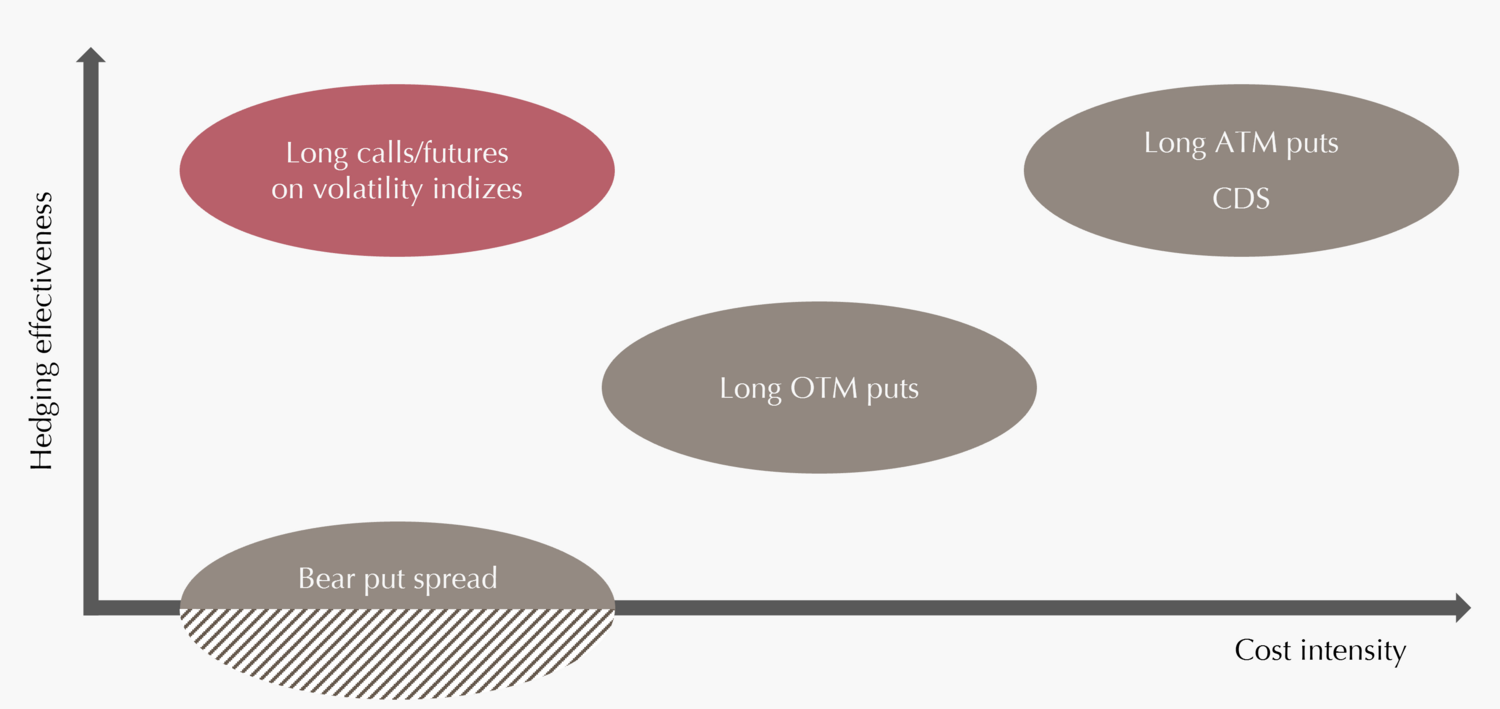

Such tail risks can be managed and mitigated in several ways. The classic and straightforward method of protecting against equity market declines is to take long positions in put options. These provide reliable protection but come at a high cost. Slightly more cost-efficient are deep out-of-the-money (OTM) puts. Because the likelihood of a significant drop in prices (i.e. below the put strike) is lower, the premium embedded in the option price is also lower.

The Cost of hedging can be reduced further by using so-called bear put spreads. This involves simultaneously holding a long and short put at different strike prices. The premium received from selling the OTM put helps offset the cost of the long position; however, there is no hedging for drawdowns that exceed the low strike price of the short put option.

Another form of “direct” protection is via swap instruments. Credit default swaps, for instance, enable fixed income investors to hedge against the default of specific issuers or securities.

Nevertheless, “indirect” hedging strategies are often more cost-effective. These approaches take advantage of typically positive correlations in times of stress. During such phases, volatility tends to spike across all markets, meaning that long call options or futures on equity volatility indices can deliver gains that help offset portfolio losses.

Managers with the right combination of expertise, technical capabilities, and hands-on experience are crucial to the success of these strategies.

Marvin

Labod

Head of Quantitative Analysis

Alexander

Raviol

Partner, CIO Derivative Solutions