Topics and markets Q4/2025

Opportunities Right on Our Doorstep

![[Translate to English:] Dr._Goetz_Albert](/fileadmin/_processed_/9/e/csm_Dr._Goetz_Albert_1_b75c5b90f5.jpg)

New year, new opportunities – particularly for Germany.

After the positive effects of the fiscal package announced in spring 2025 failed to materialize quickly, many investors turned their backs on Germany once again. Prematurely so, as the law that established the special-purpose fund for infrastructure only came into force in October of last year. The economic effects are therefore likely to become visible only this year and next, initially in the defence, construction and infrastructure sectors. Beyond that, and not least through companies acting as suppliers, we expect to see a broader transformation process that will benefit the German economy as a whole.

Investors would be well advised to position themselves now in equities of German mid-sized companies that stand to benefit from the second- and third-round effects of the fiscal package.

Yours

Dr. Götz Albert, CFA

Partner and Chief Investment Officer

German Small & Mid Caps: The Best Is Yet to Come

In the past year, German small- and mid-cap equities staged a remarkable comeback after the federal government announced a EUR 500bn special-purpose fund for infrastructure alongside significantly higher defence spending. As direct beneficiaries of these fiscal programs, share prices of smaller companies responded particularly strongly, delivering a performance of almost 25% by mid-year, despite the tariff escalation in April.

As doubts emerged about the timely implementation and effectiveness of the planned measures, optimism faded and stock prices largely moved sideways. Has the German equity market already run out of steam? Certainly not. However, a renewed market rally will require fresh catalysts.

These catalysts are set to emerge in 2026, which is why the temporary pause in the rallye of German equity indices may represent a belated entry opportunity. For next year alone, the German federal budget provides for government investment of EUR 127bn and defence spending of EUR 108bn. As the law establishing the special-purpose fund only entered into force in October last year, real economic effects are about to materialise this year and 2027. Accordingly, leading research institutes expect a significant acceleration in GDP growth in 2026 and 2027.

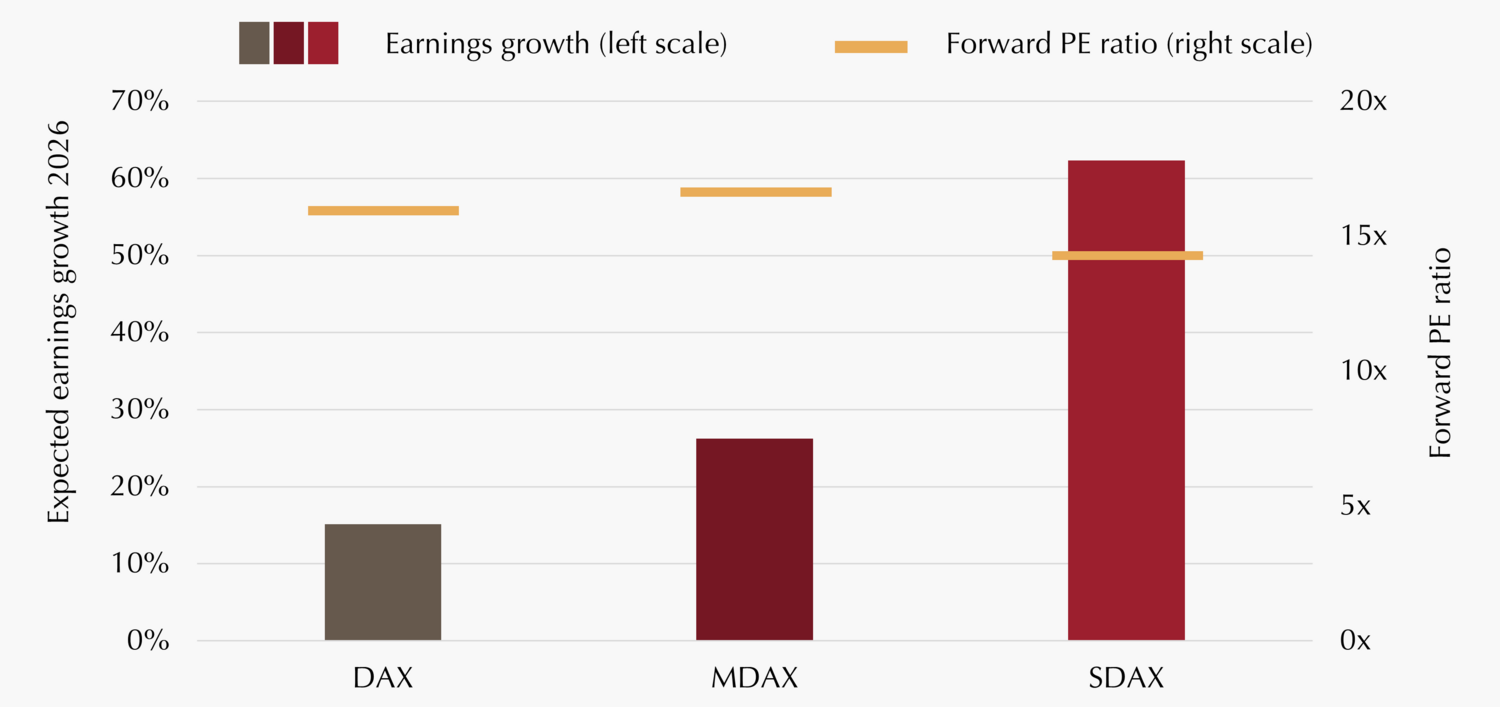

Beyond the immediate beneficiaries such as construction and defence companies, the second- and third-round effects are expected to benefit the industrially oriented “Mittelstand” in particular – including its broad base of suppliers. Analyst earnings forecasts for German small and mid caps are correspondingly impressive: expected earnings growth for SDAX constituents exceeds 60%, while MDAX companies are forecast to grow profits by nearly 30%. By comparison, large-cap stocks show a more moderate expected growth rate of around 15%.

At the same time, index valuations remain at similar, moderate levels. Investors can take advantage of this attractive opportunity by selectively allocating to companies poised to benefit from fiscal programs and its fund’s spillover to the broader economy.

Björn

Glück

CFA, Partner, Portfolio Management Small & Mid Caps Europe

Investing Early in New Megatrends with Convertible Bonds

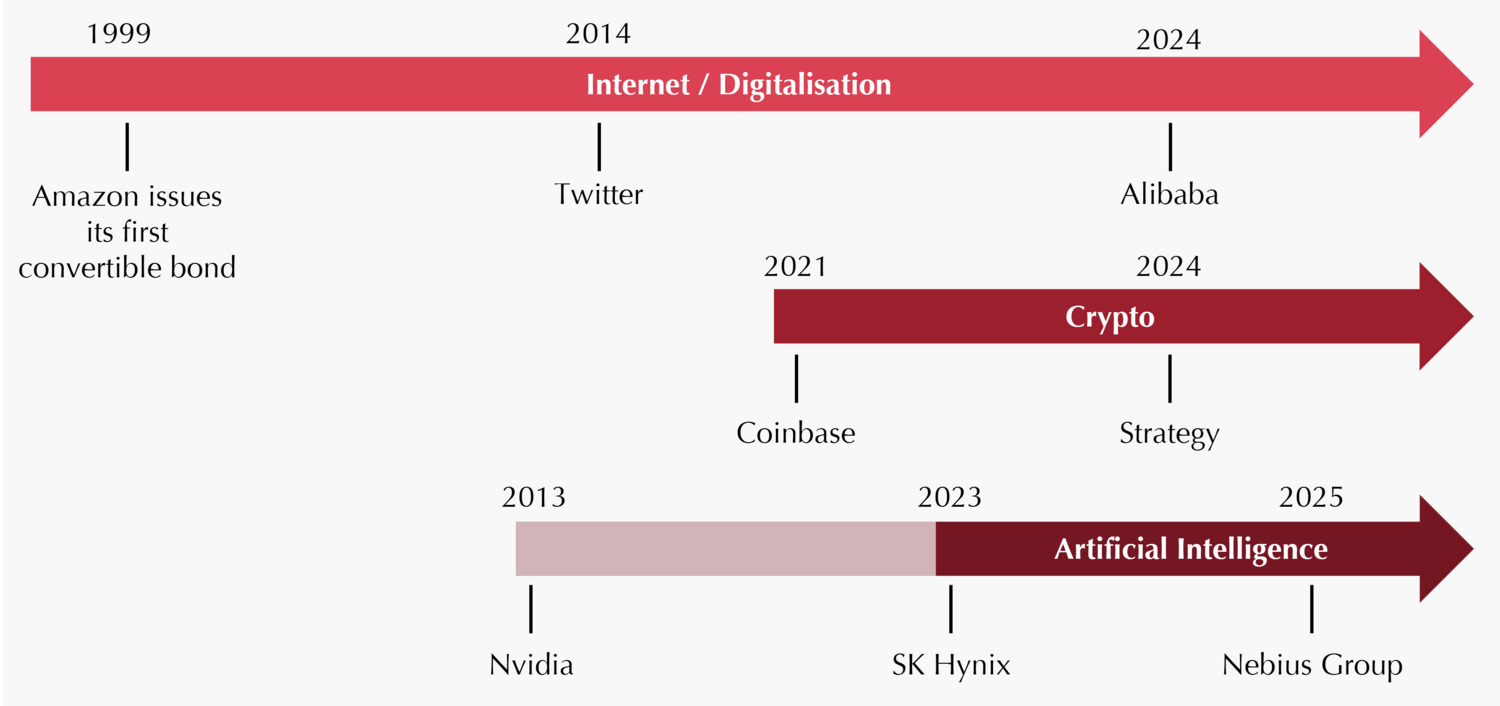

The issuer universe of convertible bonds often includes highly innovative, fast-growing companies. This has recently been evident in the enduring megatrends of artificial intelligence and cryptocurrencies. Few market segments offer such a high concentration of companies participating early in major structural changes and trends as the convertible bond market – whether directly through established AI leaders such as Nvidia or indirectly via service providers like the Dutch Nebius Group, a supplier of climate-friendly AI infrastructure.

But why are such companies that active in the convertible bond market? This is by no means a coincidence; rather, it reflects the inherent characteristics of this asset class. Convertible bonds allow relatively young companies to refinance at comparatively attractive terms, as coupons are structurally lower than those of traditional straight bonds. If a company’s success is lasting and its market capitalisation rises, investors are compensated through equity participation, which they can obtain by exercising the embedded equity option (call).

This structural advantage explains the segment’s recurring role as a thematic frontrunner. Amazon, an early internet pioneer, issued its first convertible bond as early as 1999, while Tesla, a pioneer in electric vehicles, followed in 2013. More recently, crypto platform operators such as Coinbase have also turned to the convertible bond market to finance their rapidly growing business models.

Over the last years, AI companies have offered convertible bond investors an opportunity to participate at an early stage. In a few years’ time, the issuer universe is likely to have been refreshed once again – potentially featuring new megatrends such as quantum computing or humanoid robotics.

In addition to enabling early participation in the upside potential of such trends, convertible bonds also offer a form of risk mitigation thanks to their bond component. Especially when investing in relatively young, innovative companies, this feature can prove valuable by helping to reduce portfolio volatility.

Marc-Alexander

Knieß

Portfolio Management Global Convertible Bonds

Stefan

Schauer

Portfolio Management Global Convertible Bonds

Manuel

Zell

CESGA, Portfolio Management Global Convertible Bonds

European CLOs Are More Attractive Than U.S. CLOs

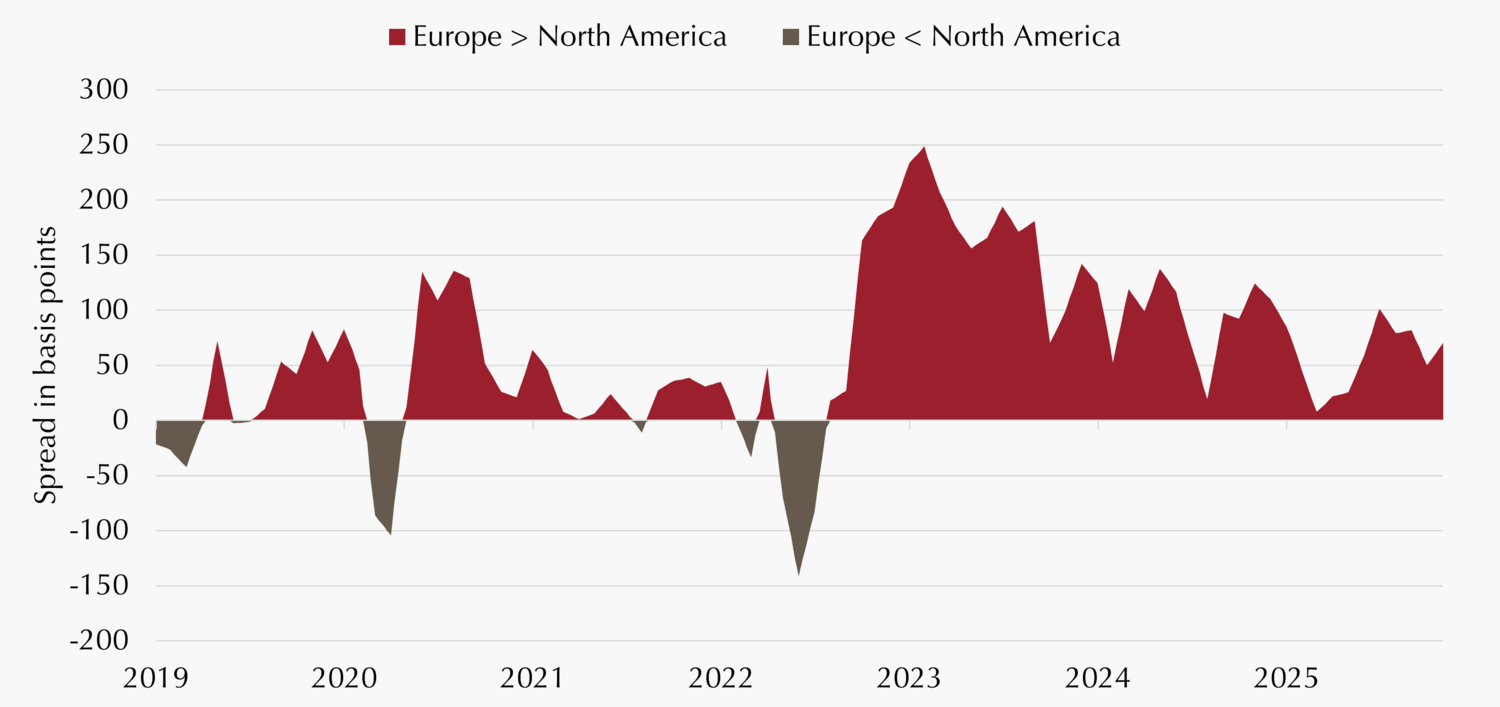

In our most recent quarterly report, we analysed the EU’s new securitisation regulation, which aims to make the European securitisation market more attractive and thereby expand it. A look across the Atlantic highlights the potential embedded in this market. The CLO market alone (a sub-segment of securitization) amounts to approximately USD 1.5 trillion in the U.S. – more than four times the size of the European market, which stands at around EUR 300bn.

Beyond this significant growth potential, a number of structural differences and advantages distinguish European CLOs from their U.S. counterparts. One example is tranche structure: European CLOs often feature a single B tranche, whereas in the U.S. market the equity tranche typically follows directly after the BB tranches.

European CLOs also exhibit a more robust security architecture. Subordination levels are higher across all rating categories, meaning that lower-rated tranches absorb a greater share of potential losses from the loan portfolio before senior tranches could be affected. In addition, European CLOs offer a higher overcollateralization across all debt tranches, since the ratio of assets (i. e. loans) to debt liabilities is higher. Furthermore, since 2018, U.S. regulation no longer requires CLO managers to retain an equity stake (“risk retention”) in the loan portfolios they manage, resulting in weaker alignment of interests between managers and investors compared with Europe.

There are also notable differences on the asset side of CLOs, i.e. the underlying loan portfolios. At first glance, U.S. CLOs appear to offer broader sector diversification. However, this is partly achieved through exposure to the energy and oil sectors, which are highly dependent on geopolitics and volatile oil prices. Therefore they are less defensive than, for example, the healthcare sector, which is strongly represented in Europe.

European loans also exhibit slightly higher spreads over the long term – around 70-80 bps more than U.S. loans. This not only enhances the earnings potential of a CLO but also provides additional protection to senior tranches, as interest payments from the loans are allocated first to the higher-rated tranches.

Norbert

Adam

Portfolio Management Fixed Income Credit

Dr.

Klaus

Ripper

Portfolio Management Fixed Income Credit

Retail Investors Are Driving Up the Volatility Premium

Short-volatility strategies benefit from the structural difference between implied volatility – reflecting market participants’ expectations – and realised volatility, which captures actual market movements. Because market participants tend to overestimate future volatility, this spread is typically positive, allowing investors to collect sustainable premiums through the ongoing sale of call and put options. In recent years, this dynamic has been further amplified by increased retail investor activity in the U.S. options market.

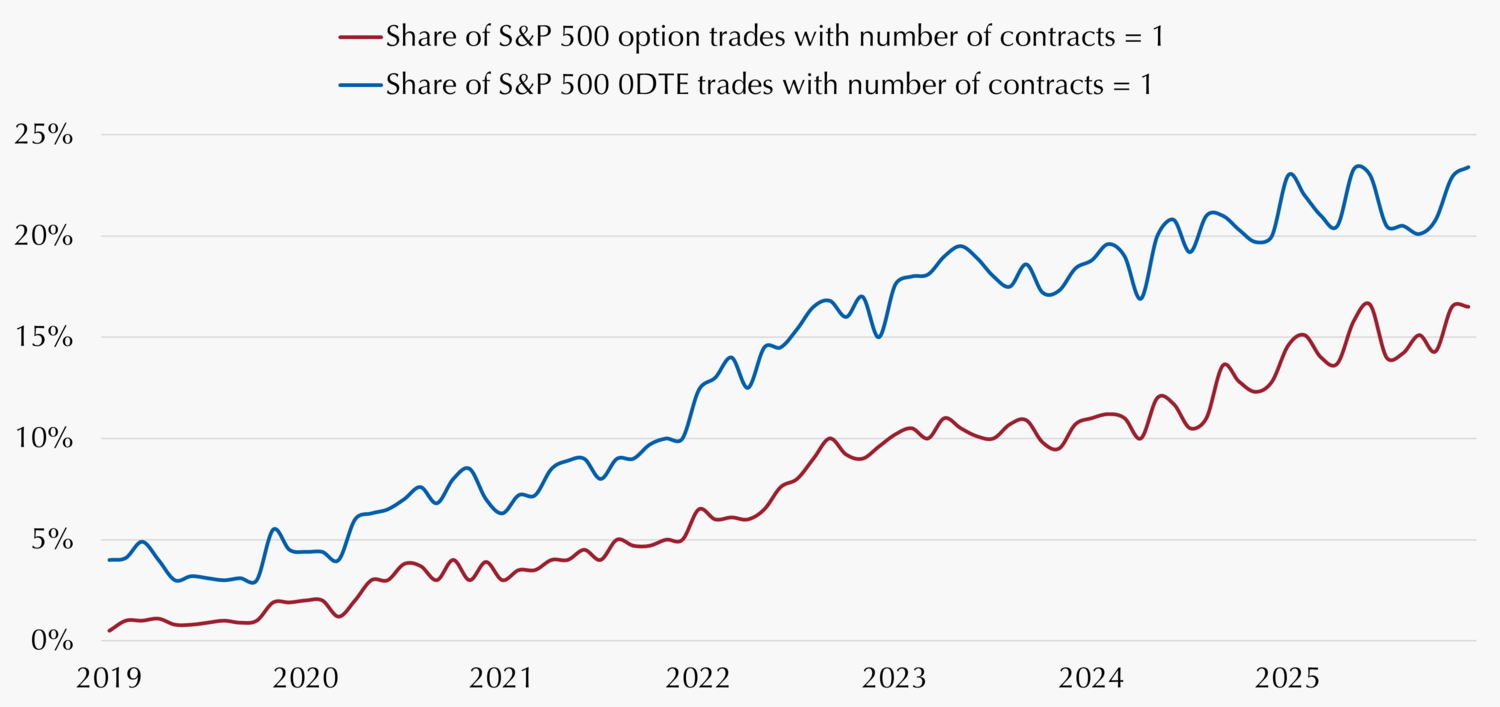

Several factors have contributed to this rise in retail participation. On the one hand, access to markets has been significantly lowered by neo-brokers offering commission-free trading and thus enabling retail investors to trade even small ticket sizes. On the other hand, the introduction of so-called zero-day-to-expiry options (0DTEs) – i. e. options with extremely short remaining maturities – has resonated particularly strongly with retail investors. As a result, they have become far more prominent in the options market than they were just a few years ago (see chart). Retail investors typically act as option buyers and are therefore positioned “long gamma.” This heightened demand tends to push option premiums higher. By contrast, short-volatility strategies take the opposing position by selling options (“short gamma”), thereby capturing the elevated premiums.

While retail investors are active in both call and put options, their increased activity in 2025 has been particularly pronounced in call options. The rise in long call positioning among retail investors was only briefly interrupted by uncertainty during the market turbulence surrounding “Liberation Day,” before rising again thereafter.

For active short-volatility strategies, these strong retail-driven flows create an opportunity to benefit from positioning accordingly. Elevated retail demand for calls can be monetised through increased selling of “upside volatility” (call options).

Increasing number of small trades as a sign of higher retail activity in the options market

Share of option trades on the S&P 500 that contain one contract in relation to the total number of traded contacts. Blue = share in zero-day-to-expiry (0DTE) options; red = share in options overall. Source: Goldman Sachs Global Investment Research, Reuters, own illustration. As of: 31.12.2025.

Mark

Ritter

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Multi-Asset Strategies Are a Thing of the Past

For decades, many investors have relied on diversified portfolios. The mix of asset classes typically varies depending on an investor’s risk tolerance. The best-known example is the 60/40 portfolio, consisting of 60% equities and 40% bonds, with the bond allocation adjusted higher or lower depending on individual preferences.

Historically, many multi-asset strategies have delivered attractive returns. In addition to strong equity performance, investors benefited from a roughly 40-year bull market in bonds. Looking ahead to coming decades, however, there are substantial reasons to doubt the future performance contribution of bonds.

Most major industrialised countries have entered a debt spiral that is simply unsustainable in an environment of persistently positive real interest rates. U.S. government debt stands at around 120% of GDP, a level last seen during World War II. China’s debt ratio has doubled over the past decade, and large eurozone countries such as France are also running high fiscal deficits. As a result, a reduction of the debt burden via central bank policies appears unavoidable.

In such a scenario, bonds are no longer an attractive portfolio allocation. Instead, investors should focus on participation in real assets – above all in equities. Those unwilling or unable to bear the full risks of equities can manage these risks through option-based capital protection strategies.

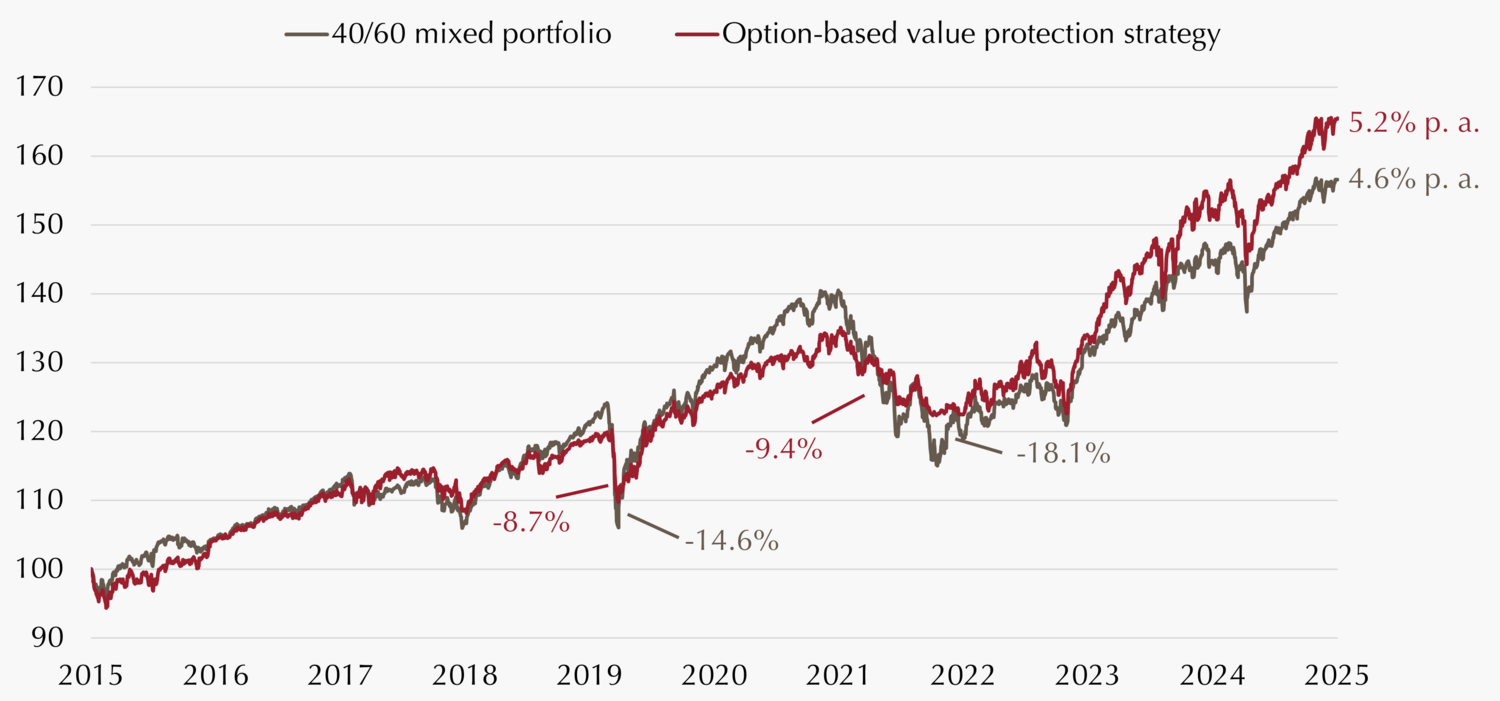

Both more aggressive and more defensive portfolio profiles can be implemented in this way – without relying on bonds as a return-generating component. The chart illustrates the superiority of such strategies over the past ten years: the performance of a defensive 40/60 portfolio was easily surpassed by an option-based capital protection strategy, while drawdowns were significantly lower. Given the weak outlook for bonds, such capital protection strategies are likely to continue to outperform in the years ahead.

Performance comparison: Mixed portfolio vs. option-based value protection strategies

Mixed portfolio consisting of 40% MSCI World 100% Hedged to EUR Net Return Index + 60% Bloomberg Global-Aggregate Total Return Index Value Hedged EUR, annual rebalancing. Option-based value protection strategy corresponds to Lupus alpha value protection strategy. Observation period: 30.12.2015 – 31.12.2025. Source: Bloomberg, own calculation and illustration. Past performance is not a reliable indicator for the future performance.

Stephan

Steiger

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Option Replication Offers Multiple Advantages

In an environment characterised by numerous crises and sources of and risk, protecting institutional portfolios against market risks is more important than ever. At the same time, many hedging strategies are costly – necessarily costly, as a closer look at option-based overlay strategies reveals. Moving beyond traditional option strategies (such as outright purchases of put option) opens up opportunities: option replication approaches enable investors to guard their portfolio at lower costs and greater flexibility – without sacrificing the desired level of protection.

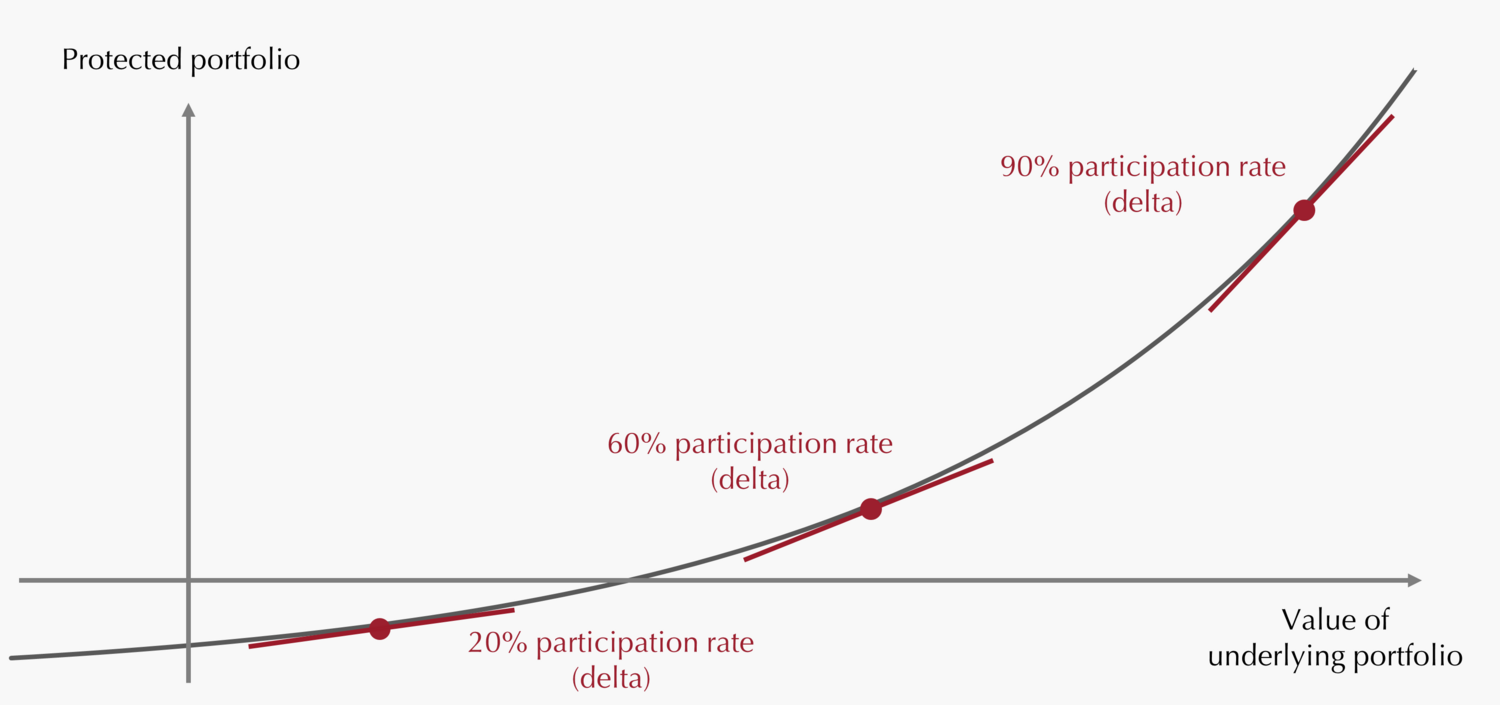

In option replication strategies, the beneficial characteristics of options are preserved by replicating their payoff profiles through the use of various liquid derivatives. For example, instruments such as futures or credit default swaps can be employed to avoid the at times substantial volatility premia embedded in the price of put options.

Replication also allows for precise hedging of portfolio components for which no (liquid) options exist in the market. Liquidity in the options market can be severely limited, particularly for underlying assets that are somewhat more exotic. Through replication, however, options with virtually any maturity and/or strike can be constructed.

Importantly, the hedging function of a put option remains intact. Downside protection for a portfolio is achieved by managing market delta exposure. This involves continuously calculating how the desired option structure can be replicated using derivatives, taking into account factors such as market prices, volatility and time to maturity in real time. As a result, hedge positions can be adjusted dynamically in response to market movements, ensuring effective portfolio protection.

For investors who are vigilant with respect to risk and costs, a risk overlay implemented via option replication represents an attractive solution. Successful implementation, however, requires a specialised overlay manager with a deep expertise, a thorough understanding of markets and strong technological capabilities.

Marvin

Labod

Head of Quantitative Analysis

Alexander

Raviol

Partner, CIO Derivative Solutions