One minute on volatility strategies: it is worth a second thought

2023 was outstanding – what is next?

Volatility strategies closed 2023 with an outstanding performance and very low volatility, underlining their positive contribution to a portfolio's overall return.

Volatility is one of the most established and stable alternative risk premia that has been observed in the liquid space for more than 30 years. A clear and comprehensible mechanism, which is similar to a classic insurance policy, enables a very attractive risk premium to be collected in absolute and risk-adjusted terms.

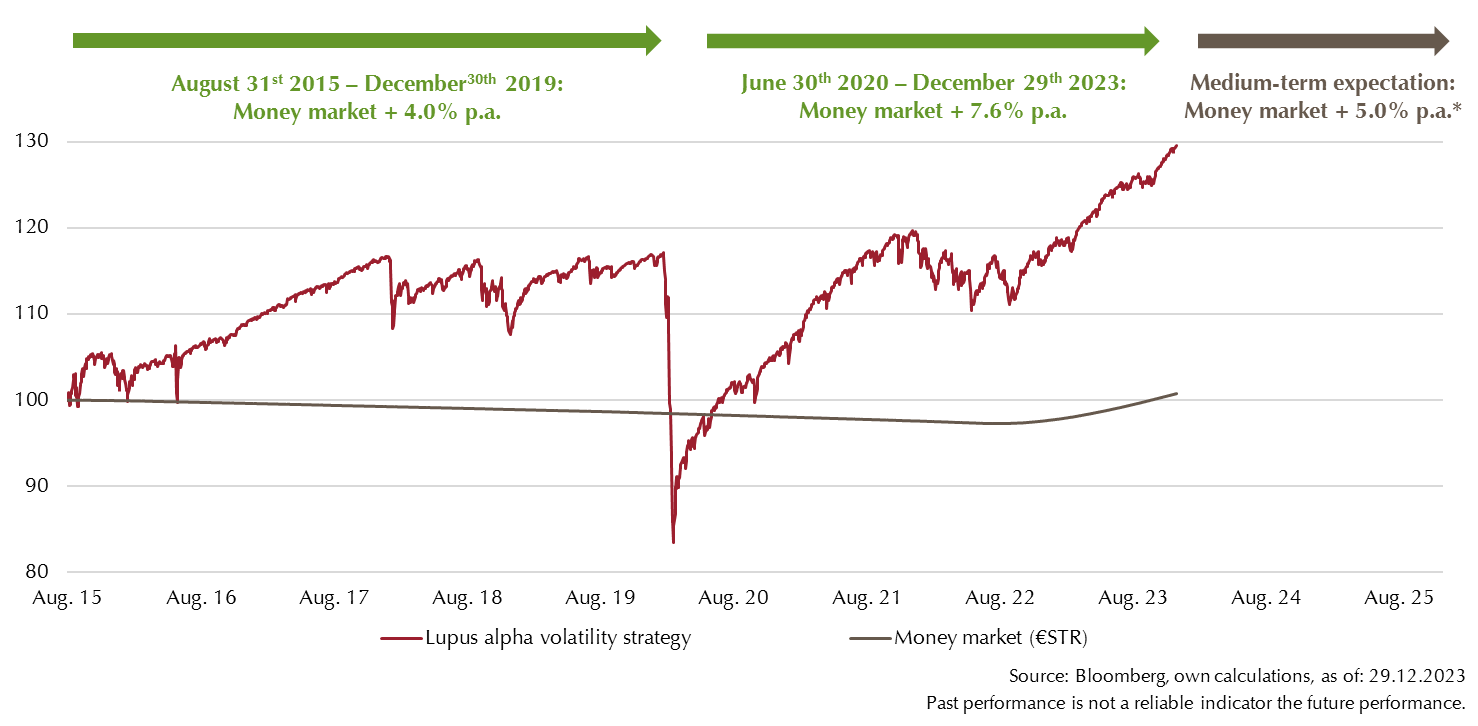

Since the sharp drawdown in 2020, volatility strategies have shown an impressive performance (see chart). Even the end of the low interest rate phase last year has not affected this positive development, on the contrary. The key to this success lies in the high volatility risk premium ("VRP"), driven by increased demand for hedging. Interestingly, many providers of insurance disappeared from the market after the coronavirus pandemic, opening up additional opportunities for the remaining investors in volatility strategies.

Currently, the medium-term total return expectation for volatility strategies is higher than ever before. But why is that? For one thing, the VRP remains at a high level. Even if it declines from the record levels after the Covid crisis, it remains higher than before the pandemic for the structural reasons mentioned above. On the other hand, volatility strategies are implemented using derivatives, based on a portfolio of short-term bonds with good credit ratings. As interest rates have risen, the expected return from the underlying portfolio has also increased.

This results in an impressive absolute return expectation of 8.0 to 8.5% in total, which is made up of around 3.5% (money market) interest and 5.0% risk premium. These figures show once again why volatility strategies should have a permanent place in every portfolio.

A HIGH RISK PREMIUM LEADS TO HIGH RETURNS FROM THE VOLATILITY STRATEGY

Past performance is not a reliable indicator for future performance. This fund information is provided for general information purposes only. This information is not designed to replace the investor‘s own market research, financial analysis, nor any other legal, tax or financial information or advice. The information presented does not constitute in any manner a solicitation activity, an invitation to buy or sell, nor an ancillary investment service such as investment research or financial analysis within the meaning of Section B(5) of Annex II, nor does it qualify as investment advice within the meaning of Section A(5) of Annex I of MiFID II (as it does not amount to an objective and independent explanation of a recommendation within the meaning of article 36,1.a) of the Delegated Regulation (EU) 2017/565 of 25 April 2016) and should not be treated by recipients as such. It does not contain any key information enabling to make important economic decisions and may differ from information and estimates provided by other sources or market participants. We accept no liability for the accuracy, completeness or topicality of this information. All statements are based on our assessment of the present legal and tax situation. All opinions reflect the current views of the portfolio manager and can be changed without prior notice. Full details of our funds and their licenses of distribution can be found in the relevant current sales prospectus and, where appropriate, Key Information Document, supplemented by the latest audited annual report and/or half-year report. The relevant sales prospectus and Key Information Documents prepared in German are the sole legally-binding basis for the purchase of funds managed by Lupus alpha Investment GmbH. You can obtain these documents free of charge from Lupus alpha Investment GmbH, P.O. Box 1112 62, 60047 Frankfurt am Main, Germany, upon request by calling +49 69 365058-7000, by e-mailing info@lupusalpha.de or via our website www.lupusalpha.de. If funds are licensed for distribution in Austria the respective sales prospectus, Key Information Document and the latest audited annual report or half-year report are available from the Austrian paying and information agent UniCredit Bank Austria AG based in Rothschildplatz 1, 1020 Vienna, Austria. Fund units can be obtained from banks, savings banks and independent financial advisors.

This document is directed at professional investors only. Therefore, neither this document nor the information made available thereon shall be construed as a distribution in or from France to any person other than professional.

Neither this fund information nor its contents or a copy thereof may be amended, reproduced or transmitted to third parties in any way without the prior written consent of Lupus alpha Investment GmbH. By accepting this document, you declare your consent to comply with the aforementioned provisions. Subject to change without notice.

Lupus alpha Investment GmbH

Speicherstraße 49–51

D-60327 Frankfurt am Main