Topics and Markets Q1/2024

Calm start for equity markets into the new year – Headwinds ahead?

![[Translate to English:] Dr._Goetz_Albert](/fileadmin/_processed_/9/e/csm_Dr._Goetz_Albert_1_b75c5b90f5.jpg)

After the turbulences of recent years, capital markets had a calm start into 2024. The stock markets celebrated one record high after another in the first quarter. But is this well founded? Are geopolitical risks really negligible and rate cuts already within reach? Has the fundamental situation changed significantly? Geopolitical disputes in Ukraine and the Middle East remain tense and inflation is proving stubborn, constantly pushing expectations for interest rate cuts to a later point in time. Investors should critically ask themselves whether the markets have adequately priced in the risks and potentially integrate hedging strategies into their portfolios.

Yours,

Dr. Götz Albert

Partner and Chief Investment Officer

Difficult situation in Europe requires active stock picking

Since the outbreak of the Ukraine war and the associated energy crisis, European and especially German companies have been viewed more critically by investors. The energy-intensive German industry in particular has been under pressure since then. In addition, political support was rarely visible, despite companies were already complaining about high taxes and increasing bureaucracy before the geopolitical upheavals.

On the equity markets, small and mid cap stocks in particular were penalised for this, as shown by the performance of German stock indices since the beginning of 2022: DAX +16%, MDAX -23% as of March. Investors seem to have a particularly negative view of the future of German SMEs, while they assume large companies to have a better foundation and a higher degree of adaptability.

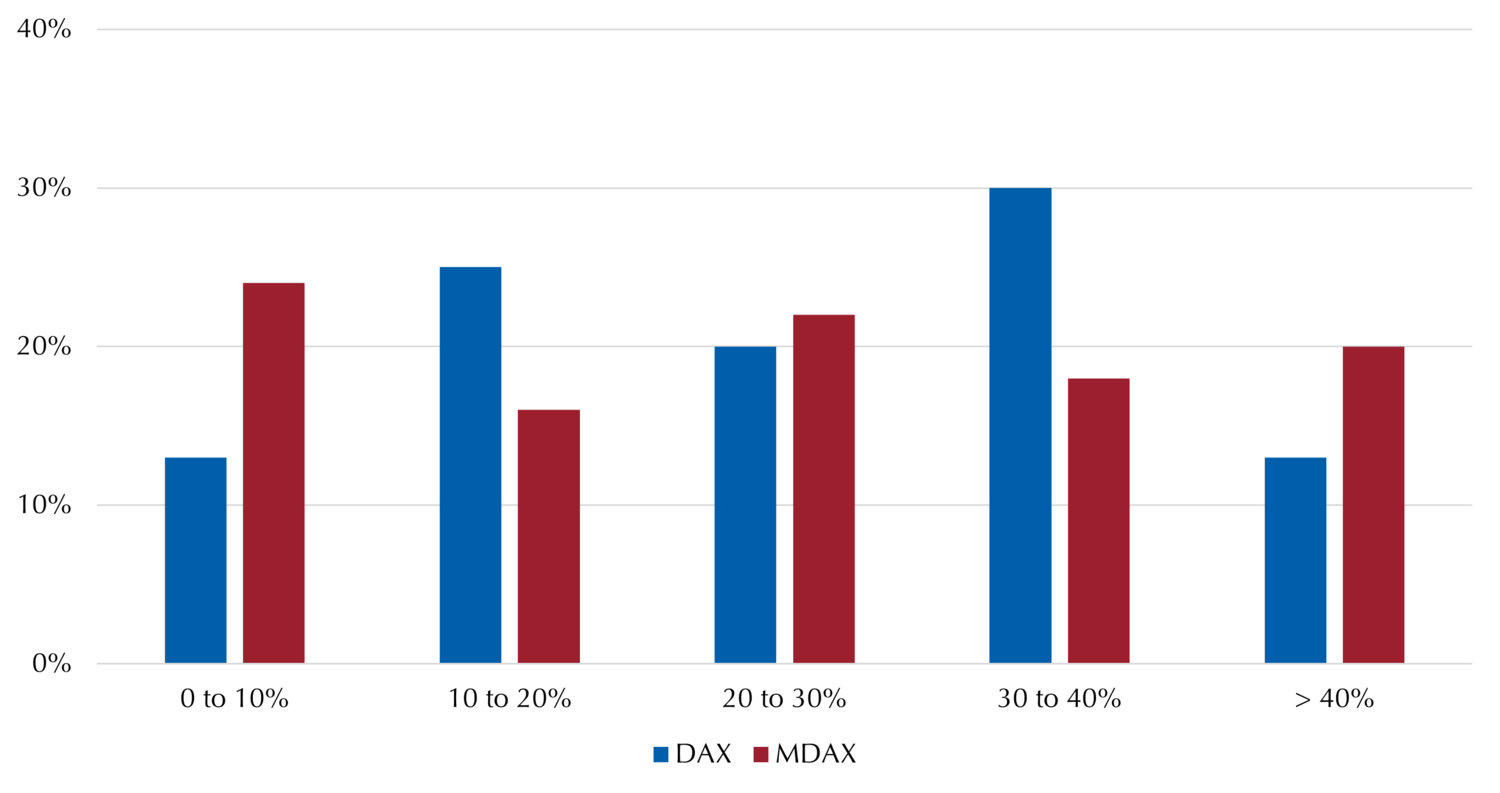

At first glance, key figures seem to confirm this assessment: MDAX companies have higher leverage and recently had a lower earnings growth on average. However, a great deal of heterogeneity within the segment can be seen upon closer inspection (see chart). Although there are more highly indebted companies in the MDAX than in the DAX, a significantly higher proportion of second-tier stocks have a negative debt position (i.e. net cash) and therefore remain virtually unaffected by the higher interest rates. In addition, the proportion of particularly fast-growing companies (> 20% p.a.) is higher in the MDAX than in the DAX. On the other hand, there are more large companies with moderate earnings growth of 0-20% p.a.

Investors should therefore take a differentiated view of German and European second-tier stocks. With fundamental research and active stock picking, it is possible to find attractive companies that are in no way inferior to German large caps. Furthermore, the business models of smaller companies in particular are characterised by a high level of innovation and flexibility in order to react to new circumstances and position themselves as tomorrow's winners.

5y earnings growth (CAGR)

Björn Glück

CFA, Partner, Portfolio Management Small & Mid Caps Europe

Primary market with a strong start and high quality

Since the second half of 2023, primary market activity in the convertible bond market had already been expected to increase. As explained in more detail in our last issue of alpha insights, this is mainly due to the so-called “maturity wall”: Many companies will have to refinance much of their debt over the next two to three years, considering convertible bonds in particular as a favourable refinancing instrument compared to conventional bonds.

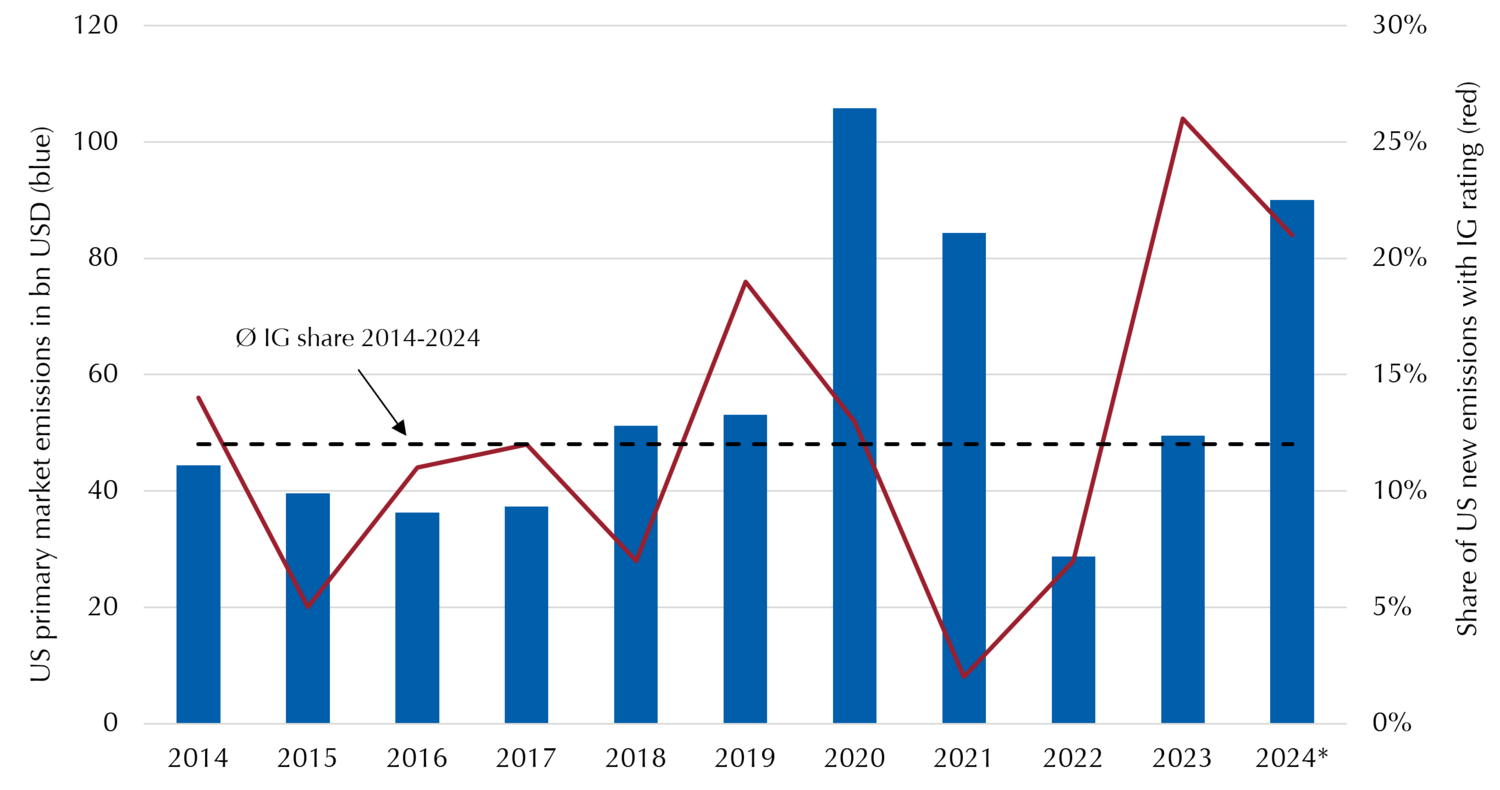

These forecasts now seem to materialise. In the first quarter, more than $25 billion of convertible bonds were issued worldwide, exceeding even optimistic expectations. After hardly any emissions were observed at the beginning of the year, emission activity has increased substantially in March. Two factors are likely to be decisive here:

Firstly, an increasing number of companies seem to realise that the elevated level of interest rates is likely to last for longer. The hope of being able to replace maturing debt on more favourable terms after the first rate cuts appears to be an increasingly risky strategy given the ever-shifting forecasts for the start of a new loosening cycle. As a result, convertible bonds are becoming more attractive as a comparatively favourable (re-)financing instrument.

In addition, strong equity markets have historically supported primary market activity of convertible bonds. In contrast to the equally strong emission year 2021, in which young, unprofitable companies in particular tried to benefit from the market situation, the issue volume is now characterised by a significantly higher proportion of issuers with investment grade credit ratings. This opens up attractive investment opportunities for investors who intend to benefit from the equity markets’ potential without losing sight of the stability provided by the bond floor.

Marc-Alexander Knieß

Portfolio Management Global Convertible Bonds

Stefan Schauer

Portfolio Management Global Convertible Bonds

Manuel Zell

CESGA, Portfolio Management Global Convertible Bonds

Falling high yield spreads call for scrutiny

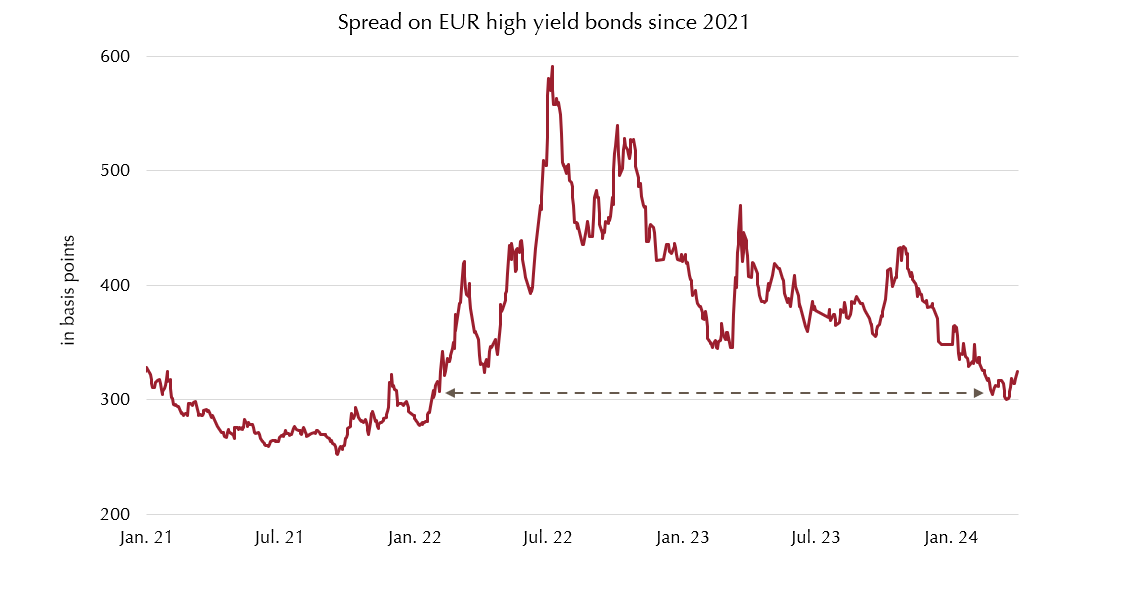

The corporate bond market is currently showing signs of easing. While two years ago the outbreak of the Ukraine war, rising inflation and interest rates rattled the markets, risk premiums in this segment have been steadily declining ever since. Only for a brief period, concerns about smaller US regional banks with high exposures to commercial real estate caused spreads to rise in the high yield segment a year ago.

While the likelihood of a new banking crisis has fallen significantly, the question is whether the markets are adequately factoring in the current risks. The geopolitical situation remains tense, inflation is more persistent than expected and the real estate sector remains under pressure due to structural shifts in the work environment. Default rates in the high yield bond market, which have risen significantly since their 2022 lows in both the US and Europe, also show that the fundamental situation is not as positive. Another warning signal for the high yield market was the downgrade to junk-level of France's second-largest telecommunications provider, Altice, with €50 billion of outstanding debt.

Despite this fundamental situation, high yield bonds are trading at risk premiums close to the levels seen at the end of 2021 (see chart) and therefore well below their long-term average over the past 10 years. Investors in this market segment should therefore ask themselves whether they are adequately remunerated for the risks taken, or whether there might be alternatives that reflect existing risks more appropriately. For example, the current high yield spread level can also be achieved in the CLO sector with tranches from the investment grade segment – with correspondingly lower risks of loss. Although spreads in this segment have also fallen significantly since their peak in autumn 2022, the spread differential between BBB-rated CLOs and high yield bonds is still in the high double digits. Hence, investors in the fixed income sector should look out for adequate risk compensation.

Dr. Klaus Ripper

Portfolio Management Fixed Income Credit

Norbert Adam

Portfolio Management Fixed Income Credit

Low correlation on the equity market drives volatility to low levels

The positive sentiment on the equity market was coupled with a low expected volatility in the first quarter. This is partly due to waning market participants’ concerns about inflation, interest rates and geopolitics. Another factor that is often overlooked, however, is the dispersion of stock market performance.

The currently rising stock markets are dominated by relatively few individual stocks. This is true both in the US, with the well-known “Magnificent 7,” as well as in Europe. While a few stocks are performing very strongly, many companies’ stock prices are moving sideways or even downwards. What effect does this have on volatility?

This can be illustrated by a hypothetical example of an index consisting of only two securities: If both stocks rise or fall in parallel, the index moves up or down accordingly. However, if the correlation between the two stocks is low or even negative, this dampens the overall index movement even when the individual stocks move strongly. In simple terms, the volatility of an index results from the volatility of individual stocks and the correlation of individual stocks to each other.

This also explains the increase in volatility during periods of stress: Such periods are usually characterised by very high correlations, as the market is sold off across the board – without the usual differentiation between sectors and individual companies.

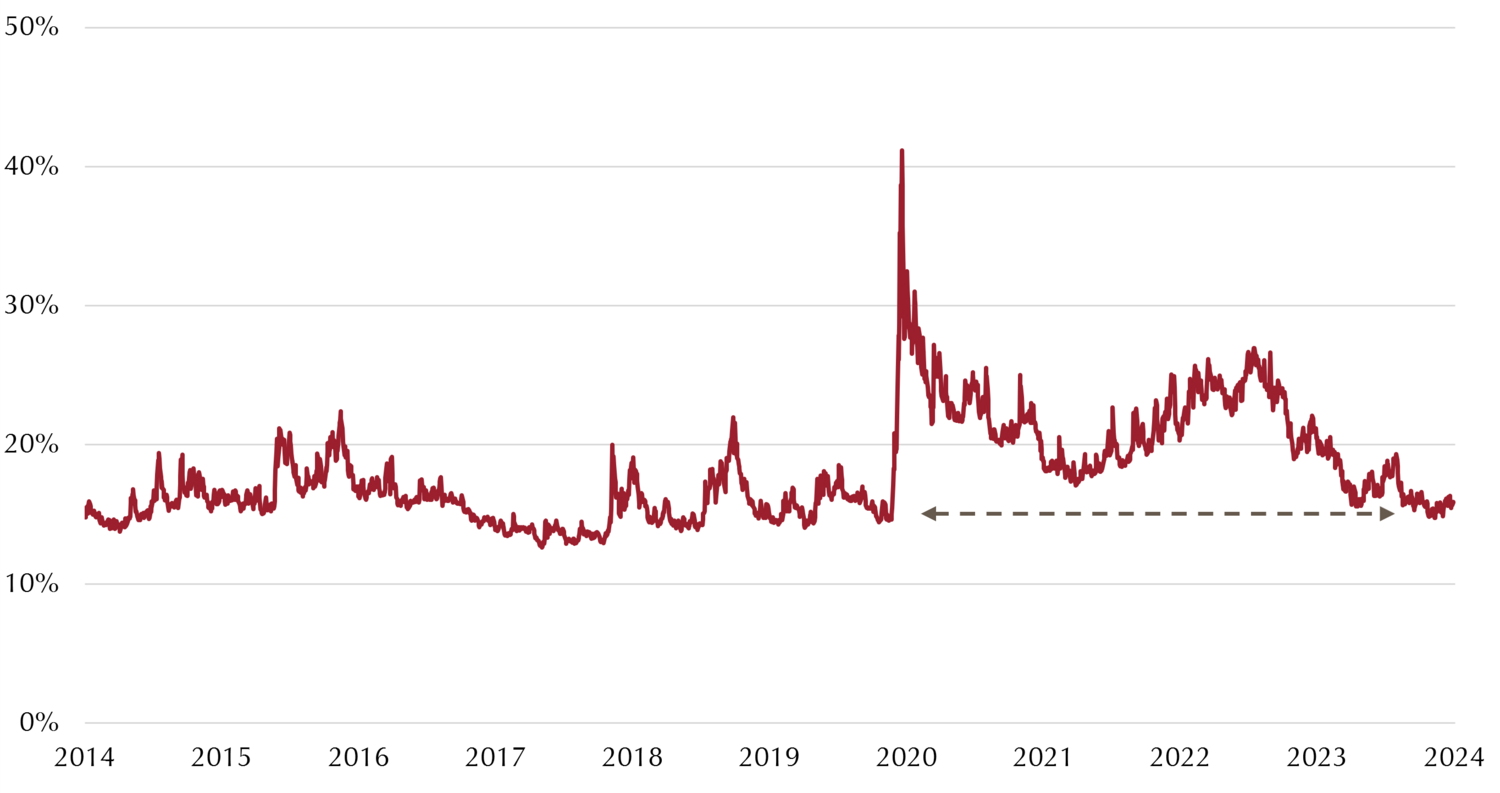

Thus, the currently low expected volatility is an expression of differentiation. Since interest rates appeared to have peaked, major tech stocks have performed very strongly, while other companies have seen weaker stock prices. On a day-to-day basis, these developments were often contradictory and dampened fluctuations at the overall market level. The markets currently expect a very low correlation as illustrated in the chart below. These expectations have been well below the 10-year average for several months now and are a key factor for the currently low level of volatility. However, realised volatility was even lower than the expected volatility which in turn led to a positive volatility risk premium in the first quarter.

Mark Ritter

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander Raviol

Partner, CIO Derivative Solutions

Low volatility increases the attractiveness of option-based strategies

After the turbulences and crises of recent years, the capital markets seem to have been relatively calm since the end of 2023. At first, one might deem this to be justified, as geopolitical conflicts seem to have been factored in, inflation is declining and interest rate cuts seem to be only a matter of time.

Despite these signs of market easing, there are still risk factors that should be kept in mind by investors: Inflation is falling, but at a much slower pace than expected, so that market participants regularly have to postpone their expectations for interest rate cuts. In addition, the positive stock market performance is accompanied by a high concentration of performance on a few tech stocks in the US and thus carries the risk of price corrections for these companies, whose valuations are quite high already. Furthermore, there are uncertainties due to the upcoming US presidential election, so that there are plenty of risk factors to bear in mind.

For risk-conscious investors who nevertheless wish to participate in the long-term opportunities of the stock market, equity value protection strategies are the method of choice. In our last quarterly, we discussed the positive effect of higher interest rates on such strategies. With the currently low expected volatility (see chart), there is now another factor that is having a positive impact on them:

Based on classical option theory, low implied volatility leads to low option prices. In consequence, option-based hedging strategies can acquire the options at more attractive prices and, with a given risk capital, build up a higher equity delta. Thus, participation opportunities can be elevated without having to sacrifice protection against downside risks. For investors, who are critical of the currently low volatility and would like to position themselves more defensively, capital protection strategies provide a solution that even benefits from current market conditions.

Stephan Steiger

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander Raviol

Partner, CIO Derivative Solutions

No need for market timing in hedging strategies

Given the calm situation prevalent in the capital markets, the issue of hedging is likely to play a minor role for many investors at the moment. However, the long-term positive trend on the stock market is regularly interrupted by (sometimes massive) drawdowns, during which investors would have wished for timely hedging. But what if investors were to circumvent the trouble of finding the right time and added a permanent risk overlay to their portfolio? What impact would this have on performance? For that matter, let us take a look back to 1910. How would a Dow Jones equity portfolio have performed with and without a risk overlay?

As one would expected from an overlay, investors would have been spared or cushioned against painful drawdowns in each of the major crises. Losses during the financial crisis, for example, could have been reduced by around 30 percentage points, which would not only have spared investors a lot of stress, but also saved them from panic sales.

However, an overlay would not only have paid off for investors in extreme situations; the volatility of the Dow Jones could also have been reduced from 18% p.a. to a more moderate 14.7%. Interestingly, the reduction in risk is not associated with a loss in performance (see chart). Instead, an average annual outperformance of around 30 basis points could have been achieved, which would have had a corresponding effect on the final portfolio value over a period of more than 100 years – thanks to the effect of compounding interest.

It is certainly extreme drawdowns that give an overlay its raison d’être, but performance in sideways and bull markets is just as crucial. These determine by far the largest period of time on the stock markets. An overlay focused solely on drawdowns will lose out in the long-term, as the costs are simply too high in normal market phases. Intelligent solutions are therefore required and offer investors the opportunity to participate in the long-term trend of the equity markets through the strategic use of call options.

Marvin Labod

Head of Quantitative Analysis

Alexander Raviol

Partner, CIO Derivative Solutions