Frankfurt, March 02nd, 2022: UCITS-compliant hedge fund strategies (liquid alternatives) performed extremely well in 2021 to record their strongest result since this Study was first published in 2008. With an average return of 6.71%, they significantly outperformed unregulated hedge funds (3.65%) and positioned themselves as an alternative to the bond market’s negative returns. Individual strategies correlate strongly with the global equity market and were given a tailwind from this direction. A net EUR 15.5 billion of new capital flowed into this investment segment. The US Federal Reserve’s comments about tightening its monetary policy had an impact during the fourth quarter as investors withdrew around EUR 1.1 billion from absolute return bond strategies.

The number of funds in the evaluated universe fell by 126 to 724 due to extraordinary effects, which initially caused volumes in this segment to decline. Nevertheless, high net inflows and exceptionally strong performance ultimately resulted in growth of EUR 9.1 billion, with a market volume of just over EUR 258 billion at the end of the year. Net inflows continued almost constantly through the year. The only net outflows were in October and primarily affected Absolute Return Bond strategies, while investors continued to favour credit strategies. Unlike bonds, credit structures often have variable interest rates and are less sensitive to rising interest rates. Investors have generally turned their backs on market-neutral strategies with low beta such as Alternative Equity Market Neutral, as they were unable to profit from rising equity markets with these strategies.

There were significant differences in average performance between different strategies within the evaluated universe in 2021, with performance ranging from -0.90% to +10.86%. There was an even larger spread in returns between different managers. This even applied to fixed-income strategies such as Absolute Return Bond, where different managers generated returns in a range between -5.75% and +18.44%.

“The exceptionally strong average returns across the entire universe of liquid alternative strategies should not obscure the fact that manager selection remains an absolutely decisive criterion for investment success,” said Ralf Lochmüller, Managing Partner and CEO of Lupus alpha. “The bigger the difference in returns between the managers of a given strategy, the more essential it is to conduct a dedicated due diligence process when selecting funds,” added Lochmüller.

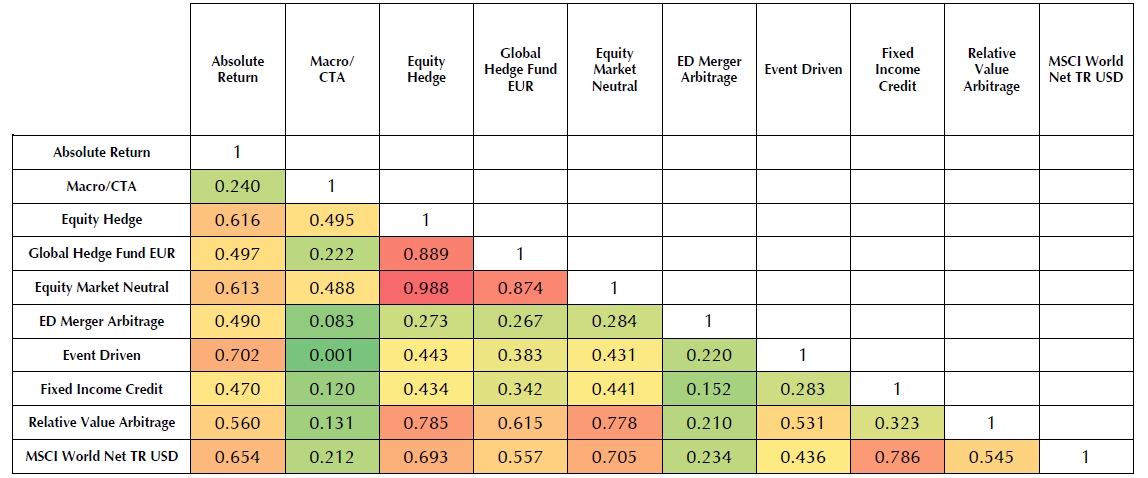

Individual liquid alternatives strategies also reveal strong correlations either with each other or with the wider equity market, including strategies such as Fixed Income Credit where you would not necessarily expect this to be the case. Investors primarily aiming to open up alternative sources of returns with liquid alternatives should include the correlation of these strategies with the equity market in their due diligence

Some strong correlation with the MSCI World equity index (5-year HFRX indices)

Source: Lupus alpha, Refinitiv

Summing up, Lochmüller said: “The overall picture shows that funds with liquid alternative strategies have delivered on their product promise. Most products recorded a positive performance in 2021, with four out of five funds showing a positive Sharpe ratio*. In addition, those who successfully selected the best funds in terms of manager selection were able to generate returns similar to those of equities. This means that UCITS-compliant hedge fund strategies remain a promising complementary asset class for investors with appropriate due diligence expertise.”

The downloadable white paper contains further detailed information, including a breakdown of the performance of individual strategies.

Download Press Relaese

* Die Sharpe-Ratio gibt die Überschussrendite einer Anlage über der sicheren Geldanlage an, bereinigt um das eingegangene Risiko (d.h. Volatilität der Renditen).