![[Translate to English:] Absolute Return Studie [Translate to English:] Absolute Return Studie](/fileadmin/_processed_/7/1/csm_Vola-Studie_8039834ee7.jpg)

Liquid alternatives: A turnaround in cash flows – interest has returned

Liquid alternatives strategies recorded net inflows of €6.9 billion in all six months of the first half of 2025. This is a clear signal of renewed interest in this asset class and confirms the turnaround that began in the second half of 2024. The fact that eight out of 14 strategies posted positive inflows also underscores the breadth of the recovery.

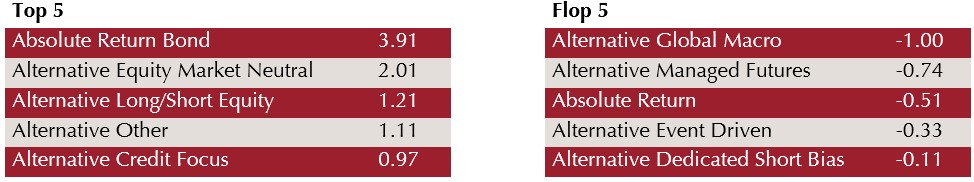

The market turbulences in April 2025, triggered by the announcement of new US tariffs, led to a noticeable shift towards lower risk strategies. The threatened tariffs acted as a catalyst for many investors to reassess their risk tolerance. The largest inflows came from the two fixed income strategies: Absolute Return Bond (+€3.91 billion) and Alternative Credit Focus (+€0.97 billion). Defensive equity strategies such as Alternative Equity Market Neutral and Alternative Long/Short Equity also benefited from increased demand.

Institutional share classes accounted for just under half of the market volume in the first half of 2025 (49.5%) – only slightly below the record level at the end of 2024 (51.7%). Particularly, lower-risk Absolute Return Funds gained (+€0.8 billion) among institutional investors, while the alternatives segment declined. The high proportion of institutional investors underlines their confidence in the robust structures of Liquid Alternatives.

The average performance across all Liquid Alternatives funds studied was -1.87% from a Euro investor perspective. The main cause of the negative return was the exceptionally strong depreciation of the US dollar (around -14% against the Euro), which had a negative impact on global strategies. Strategies with currency hedging or a focus on Europe thus showed clear benefits for European investors.

Despite the market upheaval in April, the maximum losses of many strategies remained moderate. The median for most strategies was below the MSCI World (EUR hedged: -17.1%). In particular, the fixed income strategies Absolute Return Bond (-5.3%) and Alternative Credit Focus (-5.8%) impressed with defensive risk profiles. Strategies are also stable over a period of five years: eleven out of 14 categories recorded smaller drawdowns than global equities or euro bonds.

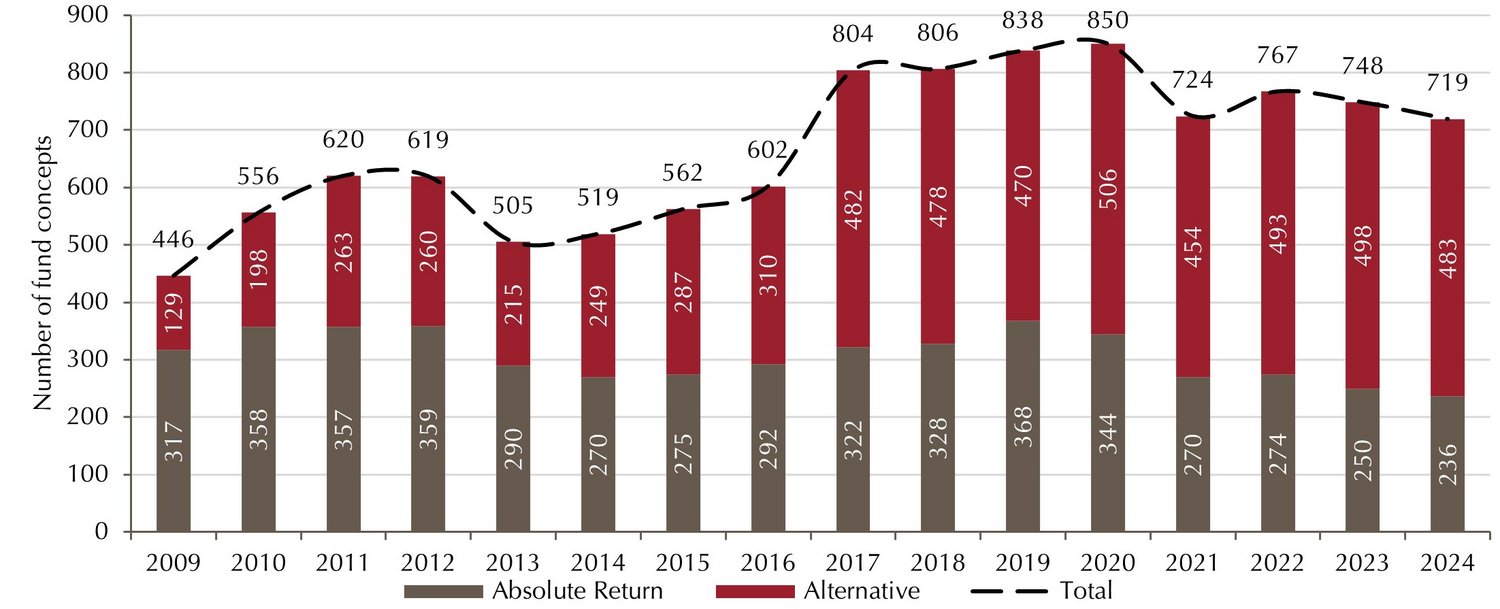

Number of funds in the segment at level of previous year

Compared to the turn of the year, the number of funds in the segment decreased by four to 715 by 30 June 2025. Hedge fund strategy providers have launched 29 UCITS funds – i.e. more funds have left the market than new ones. The Absolute Return and Alternatives sub-segments performed in opposite directions: The number of absolute return concepts decreased by 3.4% to 228 funds, while the number of alternatives increased marginally – from 483 to 487 funds. Overall, however, the ratio remains almost constant: Alternatives account for around two thirds of the funds and Absolute Return accounts for one third.

Number of funds declines

Market volume almost unchanged

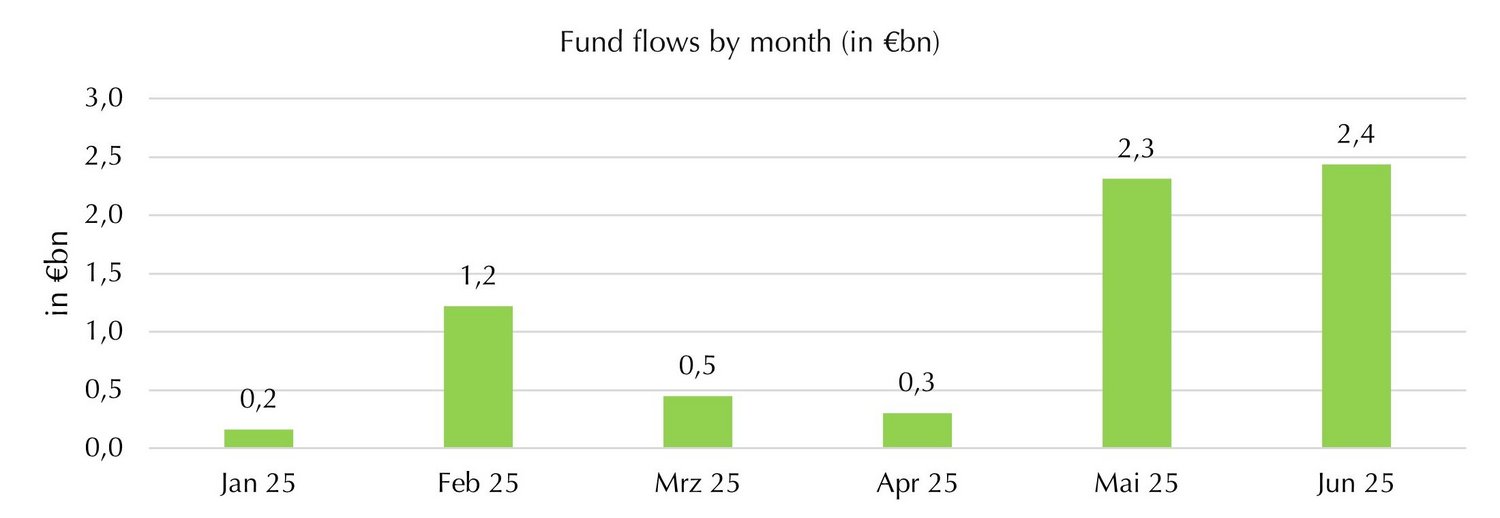

After the massive outflows in 2023, the tide turned in the second half of 2024. Although the full year was still down, net new investor capital came into the segment from mid-year onwards. This positive trend continued: In the first half of 2025, net €6.9 billion flowed into Liquid Alternatives – a clear sign of the renewed interest in this asset class.

Cash inflows did not fully offset the slightly negative performance of -1.87% (see page 7), resulting in a slight decrease in total asset class volume from €243.2 billion to €241.8 billion.

This decline is mainly at the expense of Alternative Funds, whose volume fell by €3.2 billion (-2.0%). Absolute Return funds increased their volume by €1.7 billion (2.1%). This is mainly due to the strong net inflows into the fixed income strategy “Absolute Return Bond” (€3.9 billion; see page 4).

Market volume picking up again

Absolute Return Bond strategies with the highest net inflows

After several years in which all strategies were impacted by outflows in phases, eight of the 14 strategies benefited from net inflows in the first half of 2025. The biggest winners were the Absolute Return Bond at €3.91 billion (+7.8%), Alternative Equity Market Neutral at €2.01 billion (+17.6%) and Alternative Long/Short Equity at €1.21 billion (+5.2%). These inflows show that investors prefer to increase their allocation to Liquid Alternatives defensively. In contrast, Alternative Global Macro posted outflows of €1.00 billion and Alternative Managed Futures of €0.74 billion.

US tariffs as a turning point – investors bolster portfolios with lower-risk strategies

Liquid Alternatives posted net inflows in all six months of the first half. Particularly noteworthy are May and June, which together accounted for almost 70% of total inflows. This strong demand was triggered by President Trump’s announcement of new tariffs in April. These led to some sharp market distortions on the global financial markets. Apparently, this shock has prompted many investors to reassess their risk tolerance and build portfolios more robustly. Particularly with regard to drawdown reduction, Liquid Alternatives Funds have repeatedly proven that they can significantly limit strong price declines, unlike pure equity or bond investments (see page 11). The increased allocation to Liquid Alternatives can thus be interpreted as a deliberate measure for risk management.

A closer look at inflows in May and June underscores this trend: Among the most sought-after strategies were Absolute Return Bond, Alternative Credit Focus, Alternative Long/Short Equity and Alternative Equity Market Neutral. Investors were therefore looking specifically for defensive equity and credit strategies. However, more broad-based concepts such as macro, currency or multi-strategy funds were avoided.

Fund flows by strategy (€bn)

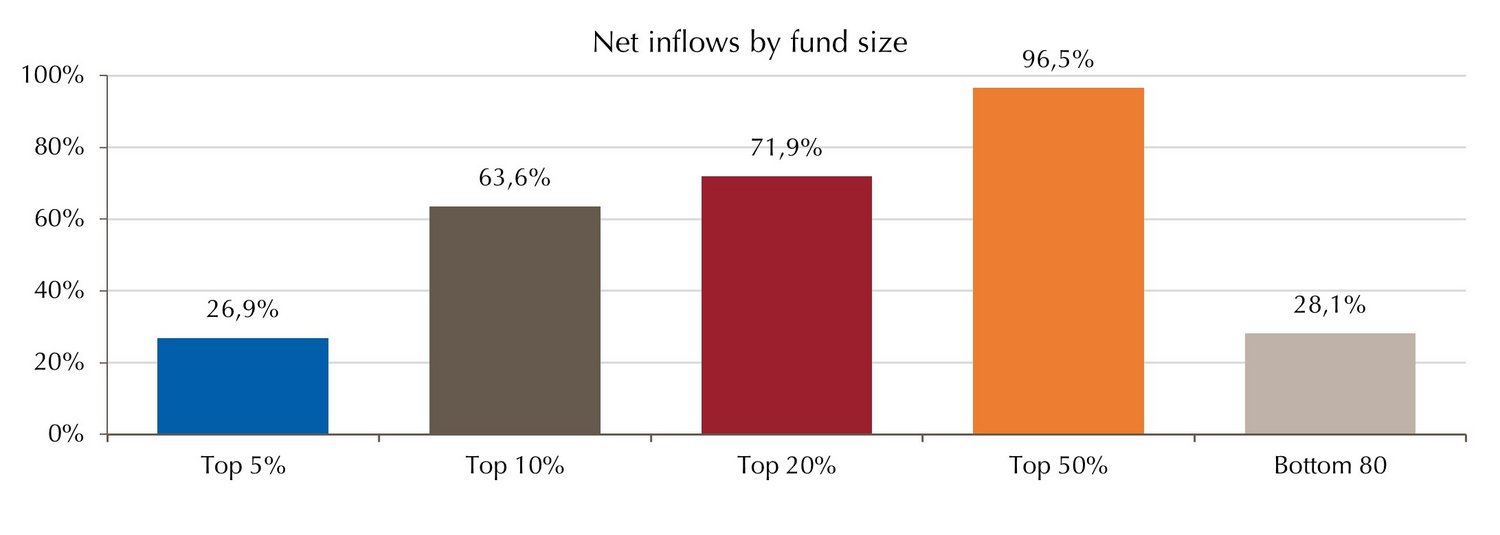

Half of funds manage almost 95% of market volume

The Liquid Alternatives segment is still dominated by a few large funds. The largest five per cent of funds attract almost twice as much capital as the smallest eighty per cent – a clear sign of the continued concentration in the market. This is particularly clear when comparing the upper and lower half of the fund universe: The better capitalised half manages 94.7% of the total market volume, while the lower half, with only around 5%, has barely any impact. The gap between large and small suppliers thus remains a key structural feature of the segment. A look at fund sizes underscores the picture of a high market concentration: 91.8% of all funds manage less than €1 billion and 83.3% manage less than €500 million. By contrast, the top 5% funds all have a volume of more than €1 billion. The top 10% of the funds each manage at least €700 million.

Top 5% of funds account for 45% of total market volume

Fixed income strategies remain dominant

The market shares of the individual strategies in the segment barely changed compared to 2024. Absolute Return Bond remains the largest strategy with a market share of 22.1% and has increased its share by a further 0.7 percentage points compared to the previous year. The second place is Alternative Multi Strategies with a market share of 19.5%. The continued strong position of alternative fixed income strategies overall is also noteworthy: Combined, Absolute Return Bond and Alternative Credit Focus achieve a market share of almost 30%, underscoring their central role within the segment.

The three largest strategies represent more than half of assets in the asset class

Weak US dollar pushes performance into negative territory for Euro investors

After the record year in 2024, with a performance of 9.26%, Liquid Alternatives funds achieved their best annual result since the start of this study; however, the first half of 2025 was significantly weaker. UCITS hedge funds averaged -1.87% underperforming both equity and bond markets.

Despite the massive market corrections in April, triggered by tariff threats and geopolitical tensions, equity markets rebounded significantly in May and June: European equities (Euro Stoxx 50) gained 10.4% in the first half of the year, while global equities (MSCI World, EUR-hedged) gained 5.88%. On the bond side, European corporate bonds posted a performance of 1.82% while European government bonds were slightly positive at 0.60%. Unregulated hedge funds moved between bonds and equities with a performance of 4.33%, significantly outperforming their regulated counterparts.

The performance of Liquid Alternatives has mainly suffered from the rapidly falling price of the US dollar. In the wake of the escalating trade conflict and falling confidence in the US dollar, it lost about 14% against the euro in the first half of the year. Such a sharp decline in the US dollar last occurred in 1973.

As a large part of the global investment universe is made up of US assets, such a sharp fall in the US dollar has a major negative impact on Euro investors investing in global funds. Thus, a positive return calculated in US dollars can quickly be reduced or even negative due to the euro currency conversion. For comparison, the MSCI World gained 9.47% from a US investor perspective (in USD) versus -3.43% for a Euro investor (in EUR) (see chart below). The EUR hedged variant used in this analysis is in between at 5.88% – the difference is due, among other things, to the difference in interest rates between the US and Europe, which influence the hedging costs.

The performance of unregulated hedge funds should also be assessed in this context: From a US investor perspective, it is +4.33%. From a European investor’s perspective, the same performance would be significantly worse due to the currency effect alone at -8.22%. Overall, only 43.3% of funds in the Liquid Alternatives segment achieved a positive return in the first half of 2025 – much weaker than in the previous year.

Disclaimer: This document serves as a study for general information purposes and is not mandatory in accordance with investment law. The information presented does not constitute an invitation to buy or sell or investment advice. It does not contain all key information required to make important economic decisions and may differ from information and estimates provided by other sources, market participants or studies. We accept no liability for the accuracy, completeness or topicality of this study. All statements are based on our assessment of the present legal and tax situation. All opinions reflect the current views of the Company and can be changed without prior notice.

Lupus alpha Investment GmbH

Speicherstraße 49-51

D-60327 Frankfurt am Main